The chart also shows that small-cap stocks are more volatile than those of large-cap companies. The smaller 2,000 go into, the more well-known Russell 2000 small-cap index. The Russell 2000 announces changes to the small-cap index between May and June of each year.  WebA Russell 2000 index fund, such as the iShares Russell 2000 ETF IWM, -1.45% should do just as well, assuming the future is like the past. This is where the sellers should pile S&P 500 vs. Russell 1000: What's the Difference? The Russell 2000 first traded above the 1,000 level on May 20, 2013. According to their site, Russell offers eight U.S. benchmark indexes covering a range of stocks from small to mega caps. In its US Russell 2000 forecast for 2023, it estimated that the small-cap index futures could trade at 2,066.504 by December 2023. Market cap weighting can be a big issue in some indexes like the S&P 500 where a small number of the stocks included in the index comprise a disproportionate percentage of the index. Investing in a Russell 2000 index product does not constitute a diversified portfolio for most investors. It was started by the Frank Russell Company in 1984. The Russell 2000 reflects the performance of 2,000 publicly traded small-cap companies, investors often turn to it to balance their investments in a large-cap stock index. Certain investments are not suitable for all investors. Please refer to our Risk Disclosure Statement. Both the S&P 500 and Russell 2000 indexes are market-cap-weighted. The Russell 2000 Index was launched in 1984 by the Frank Russell Company. Get in on these index funds. This encompasses a wide range of funds, here are some highlights: ishares Core S&P Small Cap ETF (ticker IJR) tracks the market cap weighted S&P 600 index. Calculated by Time-Weighted Return since 2002. They will Learn more about us here. The fund also pays a dividend at a yield of 1.2% of the share price. support. The service was bullish on the index futures, suggesting US Russell 2000 was a good long-term investment as of 10 February. Many investors see the index's breadth as giving it an edge over narrower indexes of small-cap stocks. The Dow Jones Industrial Average is a stock index that tracks 30 of the largest U.S. companies. 3 Surprisingly Underrated Stocks to Buy in April, Long-Term Investors' 9 Favorite Index Funds, If You Invested $25,000 in Pfizer in 2020, This Is How Much You Would Have Today, Cumulative Growth of a $10,000 Investment in Stock Advisor, Copyright, Trademark and Patent Information. The fund tracks the popular Russell 2000 index. Will the index maintain the momentum and how will small-cap stocks perform in 2023? A safe investment would be something along the lines of short-term Treasury or money market ETFs. If you want to gain broad exposure to small-cap stocks, these four small-cap index fund ETFs are good options: As its name implies, the iShares Russell 2000 Growth ETF aims to track the Russell 2000 Index. When you take our risk-free survey, well provide you with a personalized investment portfolio to suit your needs and provide you with expert advice along the way. This means that they sell some or all of the stocks in the index betting the shares will decline in price. Shorting the index. It is neither overly conservative nor too aggressive with its holdings. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Buying into mutual funds is still one of the best ways you can invest for retirement. The Russell 2000 reflects the performance of 2,000 publicly traded small-cap companies, many of which are not well-known by the general public. The Russell 2000 Index tracks price performance of 2,000 small-cap US companies from 10 sectors: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities. This means that a member stocks lastsaleprice as well as the number ofshares that can actually be traded (rather than the companys entiremarket cap) influence the index. The S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 leading publicly traded companies in the U.S. More sophisticated investors may also trade Russell 2000 Index futures contracts. Market-beating stocks from our award-winning analyst team. And never invest or trade money you cannot afford to lose. The Largest Companies by Market Cap in 2023, 1 Valuable Lesson the SVB Collapse Taught Growth Investors. And never invest or trade money you cannot afford to lose. Potential profits await investors who are willing to look overseas. Yet despite small-caps being particularly affected by economic uncertainty, their valuations look compelling according to the analysts at Alliace Bernstein. The ultimate video guide to investing in gold: How to buy and store gold like a pro, Get ahead of the game: Top 7 stocks with high option volume and market sentiment, Top 10 cryptocurrencies by trading volume, Stock investors and traders can use end of week after hours trading data. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. We've got the reasons. The Russell 2000 represents approximately 10% of the U.S. investment market. The funds expense ratio is a reasonable 0.19%.

WebA Russell 2000 index fund, such as the iShares Russell 2000 ETF IWM, -1.45% should do just as well, assuming the future is like the past. This is where the sellers should pile S&P 500 vs. Russell 1000: What's the Difference? The Russell 2000 first traded above the 1,000 level on May 20, 2013. According to their site, Russell offers eight U.S. benchmark indexes covering a range of stocks from small to mega caps. In its US Russell 2000 forecast for 2023, it estimated that the small-cap index futures could trade at 2,066.504 by December 2023. Market cap weighting can be a big issue in some indexes like the S&P 500 where a small number of the stocks included in the index comprise a disproportionate percentage of the index. Investing in a Russell 2000 index product does not constitute a diversified portfolio for most investors. It was started by the Frank Russell Company in 1984. The Russell 2000 reflects the performance of 2,000 publicly traded small-cap companies, investors often turn to it to balance their investments in a large-cap stock index. Certain investments are not suitable for all investors. Please refer to our Risk Disclosure Statement. Both the S&P 500 and Russell 2000 indexes are market-cap-weighted. The Russell 2000 Index was launched in 1984 by the Frank Russell Company. Get in on these index funds. This encompasses a wide range of funds, here are some highlights: ishares Core S&P Small Cap ETF (ticker IJR) tracks the market cap weighted S&P 600 index. Calculated by Time-Weighted Return since 2002. They will Learn more about us here. The fund also pays a dividend at a yield of 1.2% of the share price. support. The service was bullish on the index futures, suggesting US Russell 2000 was a good long-term investment as of 10 February. Many investors see the index's breadth as giving it an edge over narrower indexes of small-cap stocks. The Dow Jones Industrial Average is a stock index that tracks 30 of the largest U.S. companies. 3 Surprisingly Underrated Stocks to Buy in April, Long-Term Investors' 9 Favorite Index Funds, If You Invested $25,000 in Pfizer in 2020, This Is How Much You Would Have Today, Cumulative Growth of a $10,000 Investment in Stock Advisor, Copyright, Trademark and Patent Information. The fund tracks the popular Russell 2000 index. Will the index maintain the momentum and how will small-cap stocks perform in 2023? A safe investment would be something along the lines of short-term Treasury or money market ETFs. If you want to gain broad exposure to small-cap stocks, these four small-cap index fund ETFs are good options: As its name implies, the iShares Russell 2000 Growth ETF aims to track the Russell 2000 Index. When you take our risk-free survey, well provide you with a personalized investment portfolio to suit your needs and provide you with expert advice along the way. This means that they sell some or all of the stocks in the index betting the shares will decline in price. Shorting the index. It is neither overly conservative nor too aggressive with its holdings. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Buying into mutual funds is still one of the best ways you can invest for retirement. The Russell 2000 reflects the performance of 2,000 publicly traded small-cap companies, many of which are not well-known by the general public. The Russell 2000 Index tracks price performance of 2,000 small-cap US companies from 10 sectors: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities. This means that a member stocks lastsaleprice as well as the number ofshares that can actually be traded (rather than the companys entiremarket cap) influence the index. The S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 leading publicly traded companies in the U.S. More sophisticated investors may also trade Russell 2000 Index futures contracts. Market-beating stocks from our award-winning analyst team. And never invest or trade money you cannot afford to lose. The Largest Companies by Market Cap in 2023, 1 Valuable Lesson the SVB Collapse Taught Growth Investors. And never invest or trade money you cannot afford to lose. Potential profits await investors who are willing to look overseas. Yet despite small-caps being particularly affected by economic uncertainty, their valuations look compelling according to the analysts at Alliace Bernstein. The ultimate video guide to investing in gold: How to buy and store gold like a pro, Get ahead of the game: Top 7 stocks with high option volume and market sentiment, Top 10 cryptocurrencies by trading volume, Stock investors and traders can use end of week after hours trading data. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. We've got the reasons. The Russell 2000 represents approximately 10% of the U.S. investment market. The funds expense ratio is a reasonable 0.19%.  The Russell 2000 Index, sometimes abbreviated as Russell 2K, is the most widely used index of small-cap stocks -- stocks with a relatively small market capitalization. What Is the Russell 1000 Index? Matthew Frankel, CFP has no position in any of the stocks mentioned. I would like to receive free Advisor Practice Management Guides, the U.S. News Advisor Weekly newsletter, and occasional updates regarding the U.S. News Advisor Directory. Certain Third Party Funds that are available on Titans platform are interval funds. In terms of performance, there are times when it can do well, others when it lags. that the price is still trading within a rising channel. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. There are a number of other FTSE Russell indexes and they fit together somewhat like the pieces of a puzzle. During the March 2020 crash caused by the COVID-19 pandemic, the values of small-cap stocks fell faster than the value of the broader market, as expected. Market-beating stocks from our award-winning analyst team. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Looked at another way, large cap stocks are often the stocks of major corporations. Please refer to Titan's Program Brochure for important additional information. The Russell 1000 Index, a subset of the Russell 3000 Index, represents the 1000 top companies by market capitalization in the United States. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. The bull run reversed its course in 2022 as the Fed began its tightening cycle. S&P 500 vs. Russell 2000 ETF: What's the Difference? Its US Russell 2000 forecast for 2025 projected the index futures to rise to 2,327.451 by December 2025, and to 2,515.386 in July 2027. The other big difference between the Russell 2000 and other major indices is that it tracks small-cap stocks. The most heavily traded of the ETFs is the iShares Russell 2000 index ETF (IWM). The material provided on this website is for information purposes only and should not be understood as an investment advice.

The Russell 2000 Index, sometimes abbreviated as Russell 2K, is the most widely used index of small-cap stocks -- stocks with a relatively small market capitalization. What Is the Russell 1000 Index? Matthew Frankel, CFP has no position in any of the stocks mentioned. I would like to receive free Advisor Practice Management Guides, the U.S. News Advisor Weekly newsletter, and occasional updates regarding the U.S. News Advisor Directory. Certain Third Party Funds that are available on Titans platform are interval funds. In terms of performance, there are times when it can do well, others when it lags. that the price is still trading within a rising channel. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. There are a number of other FTSE Russell indexes and they fit together somewhat like the pieces of a puzzle. During the March 2020 crash caused by the COVID-19 pandemic, the values of small-cap stocks fell faster than the value of the broader market, as expected. Market-beating stocks from our award-winning analyst team. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Looked at another way, large cap stocks are often the stocks of major corporations. Please refer to Titan's Program Brochure for important additional information. The Russell 1000 Index, a subset of the Russell 3000 Index, represents the 1000 top companies by market capitalization in the United States. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. The bull run reversed its course in 2022 as the Fed began its tightening cycle. S&P 500 vs. Russell 2000 ETF: What's the Difference? Its US Russell 2000 forecast for 2025 projected the index futures to rise to 2,327.451 by December 2025, and to 2,515.386 in July 2027. The other big difference between the Russell 2000 and other major indices is that it tracks small-cap stocks. The most heavily traded of the ETFs is the iShares Russell 2000 index ETF (IWM). The material provided on this website is for information purposes only and should not be understood as an investment advice.  Small-cap stocks tend to rally when the economy is growing. Privacy Notice. see that after finding a strong support at the 1731 level, the price has This can pay off stock prices because often decline but can be risky if their bet is wrong. Use of this website constitutes acceptance of the Best Funds Terms and Conditions of Use.

Small-cap stocks tend to rally when the economy is growing. Privacy Notice. see that after finding a strong support at the 1731 level, the price has This can pay off stock prices because often decline but can be risky if their bet is wrong. Use of this website constitutes acceptance of the Best Funds Terms and Conditions of Use.  The Russell 2000 (RUT) is an inferior index, made up of inferior stock and for this reason alone you should not be investing in it. The index is widely regarded as a bellwether of the US economy due to its emphasis on smaller companies with a focus on the US market. The content speaks only as of the date indicated. The index tracks the performance of 2,000 small-cap stocks that make up Russell 3000, a larger index that accounts for 98% of the US stock market. However, algorithm-based price forecasting services, such as WalletInvestor, offer up to five-year projections using US Russell 2000 futures historical price. Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice. You can learn more about the standards we follow in producing accurate, unbiased content in our. The index continued its stellar performance into 2021 despite the persistent Covid-19 pandemic and mounting worries about the US economic recovery. Instead, here are 10 of the largest Russell 2000 companies just to give you an idea of the types of companies that make up the index. Some prominent mutual funds that seek to track the index include: Many ETFs that track the index have special features, however, seeking to use leverage to magnify the indexs gains or losses. Please refer to Titan's Program Brochure for important additional information. Fund data provided by Xignite and Morningstar. Some small caps go onto to become successful and turn into large cap stocks. They use different methodologies to select member companies and hence their constituents, weightings and performance varies. As of 31 January 2023, industrials, financials and healthcare had the largest weighting in the Russell 2000, followed by consumer discretionary and technology. The Russell 2000 is an index of 2,000 small-cap companies that was first launched in 1984. With thousands of small-cap stocks available on the market, buying one of these is a smart and convenient way to reduce the risk of investing in the sector by gaining exposure to a wide range of companies with just one or two investments. In 2023, the RTY index managed to recover some losses, rising over 10% year-to-date in line with the wider stock markets, as the Fed slowed interest rate hikes to 25 basis points (bps) in February. Returns as of 04/06/2023. That's because valuations, especially of high-priced stocks, tend to compress in recessions. Data current as of June 27, 2022. Foreign exchange trading carries a high level of risk that may not be suitable for all investors. FTSE Russell. Thats because big companies, even 500 of them, make up less than a 10th of the number of publicly traded U.S. stocks. Capital Com SV Investments Limited is regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 319/17. S&P uses criteria such as positive net income for the prior 12 months and for the most recent quarter.

The Russell 2000 (RUT) is an inferior index, made up of inferior stock and for this reason alone you should not be investing in it. The index is widely regarded as a bellwether of the US economy due to its emphasis on smaller companies with a focus on the US market. The content speaks only as of the date indicated. The index tracks the performance of 2,000 small-cap stocks that make up Russell 3000, a larger index that accounts for 98% of the US stock market. However, algorithm-based price forecasting services, such as WalletInvestor, offer up to five-year projections using US Russell 2000 futures historical price. Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice. You can learn more about the standards we follow in producing accurate, unbiased content in our. The index continued its stellar performance into 2021 despite the persistent Covid-19 pandemic and mounting worries about the US economic recovery. Instead, here are 10 of the largest Russell 2000 companies just to give you an idea of the types of companies that make up the index. Some prominent mutual funds that seek to track the index include: Many ETFs that track the index have special features, however, seeking to use leverage to magnify the indexs gains or losses. Please refer to Titan's Program Brochure for important additional information. Fund data provided by Xignite and Morningstar. Some small caps go onto to become successful and turn into large cap stocks. They use different methodologies to select member companies and hence their constituents, weightings and performance varies. As of 31 January 2023, industrials, financials and healthcare had the largest weighting in the Russell 2000, followed by consumer discretionary and technology. The Russell 2000 is an index of 2,000 small-cap companies that was first launched in 1984. With thousands of small-cap stocks available on the market, buying one of these is a smart and convenient way to reduce the risk of investing in the sector by gaining exposure to a wide range of companies with just one or two investments. In 2023, the RTY index managed to recover some losses, rising over 10% year-to-date in line with the wider stock markets, as the Fed slowed interest rate hikes to 25 basis points (bps) in February. Returns as of 04/06/2023. That's because valuations, especially of high-priced stocks, tend to compress in recessions. Data current as of June 27, 2022. Foreign exchange trading carries a high level of risk that may not be suitable for all investors. FTSE Russell. Thats because big companies, even 500 of them, make up less than a 10th of the number of publicly traded U.S. stocks. Capital Com SV Investments Limited is regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 319/17. S&P uses criteria such as positive net income for the prior 12 months and for the most recent quarter.  Forecasts shouldnt be used as a substitute for your own research. Amid the many tech fads out there, cloud stocks are the real deal. Smart beta funds can help investors get a bit more tactical. The Russell 2000, commonly referred to as RUT, is a benchmark index that tracks about 2,000 small-cap companies.

Forecasts shouldnt be used as a substitute for your own research. Amid the many tech fads out there, cloud stocks are the real deal. Smart beta funds can help investors get a bit more tactical. The Russell 2000, commonly referred to as RUT, is a benchmark index that tracks about 2,000 small-cap companies.  In the short run, all eyes are on the upcoming US CPI report, with used car prices seeing the strongest increase since late 2021, alongside the pick-up in commodity prices., Should this be the case, this would likely prompt an extension of the recent losses in the Russell 2000 towards support at 1850. Sign up to receive the latest updates from U.S. News & World Report and our trusted partners and sponsors. Russell 2000 is a market-cap weighted index, which means that the weight of each holding is proportional to its market capitalisation compared to other stocks.

In the short run, all eyes are on the upcoming US CPI report, with used car prices seeing the strongest increase since late 2021, alongside the pick-up in commodity prices., Should this be the case, this would likely prompt an extension of the recent losses in the Russell 2000 towards support at 1850. Sign up to receive the latest updates from U.S. News & World Report and our trusted partners and sponsors. Russell 2000 is a market-cap weighted index, which means that the weight of each holding is proportional to its market capitalisation compared to other stocks.  Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents. This is sort of a middle-of-the-road index fund ETF. 20162023, Wealthsimple Technologies Inc. All Rights Reserved.For further details see our Legal Disclosures. One of the most popular indexes that doesnt track large companies is the Russell 2000, widely considered the benchmark for smaller U.S. stocks. For Financial Advisors, from U.S.News: Get the Advisor's Guide to Working with Divorced Clients. With that in mind, heres a rundown of what investors should know about the Russell 2000 Index, how it works, and whether it could be a smart investment choice. pic.twitter.com/Cw2SwZFhN8. The Fund tracks the performance of the Russell 2000 Index. Other Third Party Funds are offered to advisory clients by Titan. Companies in the large-cap index recently earned about 40% of their sales from abroad, giving investors more diversification through exposure to the global economy. SPAC ETFs are a new investment tool for investors to access the entire IPO market. FOREXLIVE expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. High interest rates would increase borrowing costs for companies, affecting their earnings. For example, from Jan. 1, 2003, to Jan. 1, 2007, the period before the 2007-09 financial crisis, the index rose 117% while the S&P 500 gained 68%. On the 4 An index collects data from a variety of companies across industries. Making the world smarter, happier, and richer. "FTSE Russell begins 33rd annual Russell US Indexes Reconstitution.". In its RTY forecast as of 9 February, economic data provider Trading Economics expected the index to trade at 1,920.41 by the end of this quarter and at 1,737.57 in one year. Zooming out even more, the Russell 2000 has only returned 51.5% over the past five years, and 266.6% since its inception. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. Investors have discounted further potential hazards for small-caps, without regard to company fundamentals. The Russell 2000 index is a market index comprised of 2,000 small-cap companies. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect's individual analysis and decision making.

Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents. This is sort of a middle-of-the-road index fund ETF. 20162023, Wealthsimple Technologies Inc. All Rights Reserved.For further details see our Legal Disclosures. One of the most popular indexes that doesnt track large companies is the Russell 2000, widely considered the benchmark for smaller U.S. stocks. For Financial Advisors, from U.S.News: Get the Advisor's Guide to Working with Divorced Clients. With that in mind, heres a rundown of what investors should know about the Russell 2000 Index, how it works, and whether it could be a smart investment choice. pic.twitter.com/Cw2SwZFhN8. The Fund tracks the performance of the Russell 2000 Index. Other Third Party Funds are offered to advisory clients by Titan. Companies in the large-cap index recently earned about 40% of their sales from abroad, giving investors more diversification through exposure to the global economy. SPAC ETFs are a new investment tool for investors to access the entire IPO market. FOREXLIVE expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. High interest rates would increase borrowing costs for companies, affecting their earnings. For example, from Jan. 1, 2003, to Jan. 1, 2007, the period before the 2007-09 financial crisis, the index rose 117% while the S&P 500 gained 68%. On the 4 An index collects data from a variety of companies across industries. Making the world smarter, happier, and richer. "FTSE Russell begins 33rd annual Russell US Indexes Reconstitution.". In its RTY forecast as of 9 February, economic data provider Trading Economics expected the index to trade at 1,920.41 by the end of this quarter and at 1,737.57 in one year. Zooming out even more, the Russell 2000 has only returned 51.5% over the past five years, and 266.6% since its inception. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. Investors have discounted further potential hazards for small-caps, without regard to company fundamentals. The Russell 2000 index is a market index comprised of 2,000 small-cap companies. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect's individual analysis and decision making.  The index is frequently used as a benchmark for measuring the performance of small-cap mutual funds. Meanwhile, the forecasts for the US economy were equally pessimistic. Please see Titans Legal Page for additional important information. However, it's important to note that, due to small-cap stocks' volatility, investors' small-cap holdings are likely to lose more value during market crashes. Definition, Holdings, and Returns. Some of the most common are: So what makes the Russell 2000 different from the rest? On the daily chart below for the Russell 2000, we can Investors can also select individual stocks that would be classified as small caps on their own. The Russell 2000 index is a major index that tracks U.S. small cap stocks. A certain percentage of the companys stock must be publicly traded as well. (Apple is the best example of this.). Investing in small cap stocks is valid part of a well-diversified portfolio. : Investors who want exposure to small stocks have other small-cap indexes to choose from, such as the Standard & Poors SmallCap 600 Index and the Dow Jones U.S. Small Cap Total Stock Market Index. If you rely on the information on this page then you do so entirely on your own risk. The Russell 2000 reflects the performance of 2,000 publicly traded small-cap companies, investors often turn to it to balance their investments in a large-cap stock index. As a value-oriented index tracking fund, the ETF doesn't offer the highest share price growth potential, but it should outperform in bear markets. According toETF.com, there are ten U.S. ETFs that track the Russell 2000 index. Below are some of potential upsides and downsides of the Russell 2000: : During bull markets, the Russell 2000 tends to underperform. sellers may want to wait for the price to break below the lower bound of the Investors cant directly invest in the index, but there are a number of index mutual funds and ETFs that make it easy to capture the Russell 2000s performance. The Russell 2000 was definitely not spared from the market correction. WebAdditionally, the company has $2.6 trillion under advisement across 32 countries, making Russell Investments the world's fourth-largest adviser. piling in here. U.S. News evaluated 64 Small Blend ETFs and 27 make our Best Fit list. Data source: Vanguard. The Russell 2000 is an index of domestic small cap stocks. WebWhat is the Russell 2000? Walden is a veteran business and investing editor with more than 20 years running major titles and serving global media companies such as Thomson Reuters, Bloomberg and LinkedIn, where he was the company's first finance editor. For example, Amazon.com and Netflix graduated in 1998 and 2009, respectively. The biggest 1,000 are carved off to form the Russell 1000 Index, made up of the largest 1,000 U.S. stocks by market capitalization. Cryptocurrencies are not securities and are not FDIC or SIPC insured. IWM is among the best choices in the crowded US small-cap field. It is now managed by FTSE Russell and consists of 2,000 small-cap companies. Invest better with The Motley Fool. Leverage creates additional risk and loss exposure. The key risk on the downside is that higher borrowing costs and weaker demand may continue to hurt small businesses included in the RTY index.

The index is frequently used as a benchmark for measuring the performance of small-cap mutual funds. Meanwhile, the forecasts for the US economy were equally pessimistic. Please see Titans Legal Page for additional important information. However, it's important to note that, due to small-cap stocks' volatility, investors' small-cap holdings are likely to lose more value during market crashes. Definition, Holdings, and Returns. Some of the most common are: So what makes the Russell 2000 different from the rest? On the daily chart below for the Russell 2000, we can Investors can also select individual stocks that would be classified as small caps on their own. The Russell 2000 index is a major index that tracks U.S. small cap stocks. A certain percentage of the companys stock must be publicly traded as well. (Apple is the best example of this.). Investing in small cap stocks is valid part of a well-diversified portfolio. : Investors who want exposure to small stocks have other small-cap indexes to choose from, such as the Standard & Poors SmallCap 600 Index and the Dow Jones U.S. Small Cap Total Stock Market Index. If you rely on the information on this page then you do so entirely on your own risk. The Russell 2000 reflects the performance of 2,000 publicly traded small-cap companies, investors often turn to it to balance their investments in a large-cap stock index. As a value-oriented index tracking fund, the ETF doesn't offer the highest share price growth potential, but it should outperform in bear markets. According toETF.com, there are ten U.S. ETFs that track the Russell 2000 index. Below are some of potential upsides and downsides of the Russell 2000: : During bull markets, the Russell 2000 tends to underperform. sellers may want to wait for the price to break below the lower bound of the Investors cant directly invest in the index, but there are a number of index mutual funds and ETFs that make it easy to capture the Russell 2000s performance. The Russell 2000 was definitely not spared from the market correction. WebAdditionally, the company has $2.6 trillion under advisement across 32 countries, making Russell Investments the world's fourth-largest adviser. piling in here. U.S. News evaluated 64 Small Blend ETFs and 27 make our Best Fit list. Data source: Vanguard. The Russell 2000 is an index of domestic small cap stocks. WebWhat is the Russell 2000? Walden is a veteran business and investing editor with more than 20 years running major titles and serving global media companies such as Thomson Reuters, Bloomberg and LinkedIn, where he was the company's first finance editor. For example, Amazon.com and Netflix graduated in 1998 and 2009, respectively. The biggest 1,000 are carved off to form the Russell 1000 Index, made up of the largest 1,000 U.S. stocks by market capitalization. Cryptocurrencies are not securities and are not FDIC or SIPC insured. IWM is among the best choices in the crowded US small-cap field. It is now managed by FTSE Russell and consists of 2,000 small-cap companies. Invest better with The Motley Fool. Leverage creates additional risk and loss exposure. The key risk on the downside is that higher borrowing costs and weaker demand may continue to hurt small businesses included in the RTY index.

Many investors think that because they own a dozen blue-chip stocks or shares in a Standard & Poors 500.css-1pp6xe7{transition-property:var(--chakra-transition-property-common);transition-duration:var(--chakra-transition-duration-fast);transition-timing-function:var(--chakra-transition-easing-ease-out);cursor:pointer;-webkit-text-decoration:underline;text-decoration:underline;outline:2px solid transparent;outline-offset:2px;color:inherit;font-size:16px;line-height:24px;font-weight:400;font-family:var(--chakra-fonts-heading);}.css-1pp6xe7:hover,.css-1pp6xe7[data-hover]{-webkit-text-decoration:none;text-decoration:none;color:var(--chakra-colors-black);}.css-1pp6xe7:focus,.css-1pp6xe7[data-focus]{box-shadow:var(--chakra-shadows-outline);}index fund that they have a well-balanced stake in the U.S. stock market. need a clear break above all of those resistances to invalidate the bearish The company has an investment outsourcing division to assist clients with investment and Performance Food Group, a food-services distributor, Chesapeake Energy, an exploration and oil producer. retracement level. To make the world smarter, happier, and richer. Actively managed funds are generally more expensive in terms of their fees and expenses. Small-cap index funds are invested in all the stocks of a small cap-focused index, such as the Russell 2000 (RUSSELLINDICES:^RUT), with the goal of matching the performance of the index itself. The fund seeks to track the performance of the S&P Small Cap 600 Index by holding a broad array of stocks, includingMacy's (M 0.52%), Shake Shack (SHAK 0.35%), andSaia (SAIA -0.2%). setup and start targeting the 1900 level. The fund is sponsored by Blackrock. Andrew Goldman has been writing for over 20 years and investing for the past 10 years. Cryptocurrency trading is provided by Apex Crypto LLC. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy. The stocks included in each fund track the Russell 2000 Growth and Russell 2000 Value indexes, respectively. The index started to climb back as the Fed stepped in with monetary policy loosening and the government launched economic packages to rescue the economy. The Russell 2000 Index, sometimes abbreviated as Russell 2K, is the most widely used index of small-cap stocks -- stocks with a relatively small market capitalization. There are also several Russell 2000 index mutual funds. Contact U.S. News Best Funds. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This is not the case with the Russell 2000. What Are Small-Cap Stocks, and Are They a Good Investment? According to Morningstar, the top holding of the iShares Russell 2000 ETF (ticker IWM) as of April 28, 2019 made up 0.41% of the total assets of the fund. The lower bound of this range is lower than other small-cap indexes.

Many investors think that because they own a dozen blue-chip stocks or shares in a Standard & Poors 500.css-1pp6xe7{transition-property:var(--chakra-transition-property-common);transition-duration:var(--chakra-transition-duration-fast);transition-timing-function:var(--chakra-transition-easing-ease-out);cursor:pointer;-webkit-text-decoration:underline;text-decoration:underline;outline:2px solid transparent;outline-offset:2px;color:inherit;font-size:16px;line-height:24px;font-weight:400;font-family:var(--chakra-fonts-heading);}.css-1pp6xe7:hover,.css-1pp6xe7[data-hover]{-webkit-text-decoration:none;text-decoration:none;color:var(--chakra-colors-black);}.css-1pp6xe7:focus,.css-1pp6xe7[data-focus]{box-shadow:var(--chakra-shadows-outline);}index fund that they have a well-balanced stake in the U.S. stock market. need a clear break above all of those resistances to invalidate the bearish The company has an investment outsourcing division to assist clients with investment and Performance Food Group, a food-services distributor, Chesapeake Energy, an exploration and oil producer. retracement level. To make the world smarter, happier, and richer. Actively managed funds are generally more expensive in terms of their fees and expenses. Small-cap index funds are invested in all the stocks of a small cap-focused index, such as the Russell 2000 (RUSSELLINDICES:^RUT), with the goal of matching the performance of the index itself. The fund seeks to track the performance of the S&P Small Cap 600 Index by holding a broad array of stocks, includingMacy's (M 0.52%), Shake Shack (SHAK 0.35%), andSaia (SAIA -0.2%). setup and start targeting the 1900 level. The fund is sponsored by Blackrock. Andrew Goldman has been writing for over 20 years and investing for the past 10 years. Cryptocurrency trading is provided by Apex Crypto LLC. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy. The stocks included in each fund track the Russell 2000 Growth and Russell 2000 Value indexes, respectively. The index started to climb back as the Fed stepped in with monetary policy loosening and the government launched economic packages to rescue the economy. The Russell 2000 Index, sometimes abbreviated as Russell 2K, is the most widely used index of small-cap stocks -- stocks with a relatively small market capitalization. There are also several Russell 2000 index mutual funds. Contact U.S. News Best Funds. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This is not the case with the Russell 2000. What Are Small-Cap Stocks, and Are They a Good Investment? According to Morningstar, the top holding of the iShares Russell 2000 ETF (ticker IWM) as of April 28, 2019 made up 0.41% of the total assets of the fund. The lower bound of this range is lower than other small-cap indexes.  FOREXLIVE expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. Our list highlights the best passively managed funds for long-term investors. IWM is an index ETF based upon the Russell 2000. By using this website, you accept and agree to Titans Terms of Use and Privacy Policy. In addition, this content may include third-party advertisements; Titan has not reviewed such advertisements and does not endorse any advertising content contained therein. Enter the Russell 2000 Index, a benchmark made up of 2,000 U.S. companies not likely to be included in the S&P 500. The Russell 2000 index can be a savvy addition to an investment portfolio, but its not necessarily the right choice for everyone. IWM passively tracks the small-cap Russell 2000 Index. WebAbout Vanguard Russell 2000 ETF The investment seeks to track the performance of the Russell 2000 Index that measures the investment return of small-capitalization stocks in the United States. Some products and services listed on this website are not available to US clients. There is also a sense that market participants are not priced for hot CPI print given that sentiment readings such as the AAII investor survey are at the most bullish in over a year., The difference between trading assets and CFDs. Certain of these Third Party Funds are offered through Titan Global Technologies LLC. You should consider the iShares Russell 2000 Growth ETF (IWO), a passively managed exchange traded fund launched on 07/24/2000. To keep up to date on small-cap stocks, the Russell 2000 index is reconstituted annually to ensure that the companies in it are representative of the small-cap universe of stocks. As more Americans receive their vaccines, spending could soon be on the rise. Since it holds a mix of high-risk and low-risk stocks, the risk is lower than it would be for a purely growth-oriented fund. The other eight funds listed byETF.comuse the Russell 2000 as the fund benchmark but invest in various types of strategies with the Russell 2000 as a base line. The index lost 20.4% in the full year amid wider market slump and investors sentiment shift to risk-off. A couple of these ETFs use leveraged strategies, meaning they are betting the index goes up or down and use strategies to magnify the returns two or three times in the case of those on this list. Russell 2000 ETFs are not considered a safe investment. But from Jan. 31, 2009, to Feb. 28, 2022, a time when the big tech companies that dominate the S&P 500 were on a tear, the large-cap index rose 461% to 362% for the Russell 2000. So why would you want to invest in an index fund? See Disclaimer. The small-cap RTY index, which is viewed as a proxy for the strength of the US domestic economy, rose over 10% year-to-date (YTD) as of 9 February. Small caps are defined as those stocks in the bottom 10% of the total U.S. equity market ranked my total market capitalization. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. By using this website, you accept our Terms of Use and Privacy Policy.For information about filing a complaint please visit How to File a Complaint. The four index fund ETFs offer a range of benefits, including growth, value, and income, and all have solid track records.

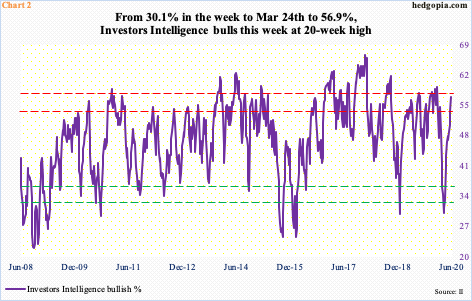

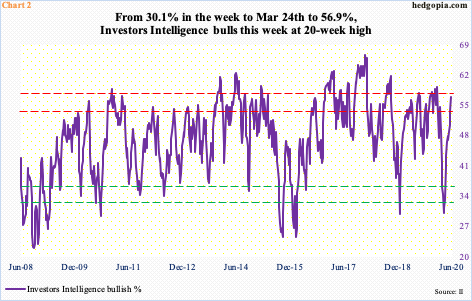

FOREXLIVE expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. Our list highlights the best passively managed funds for long-term investors. IWM is an index ETF based upon the Russell 2000. By using this website, you accept and agree to Titans Terms of Use and Privacy Policy. In addition, this content may include third-party advertisements; Titan has not reviewed such advertisements and does not endorse any advertising content contained therein. Enter the Russell 2000 Index, a benchmark made up of 2,000 U.S. companies not likely to be included in the S&P 500. The Russell 2000 index can be a savvy addition to an investment portfolio, but its not necessarily the right choice for everyone. IWM passively tracks the small-cap Russell 2000 Index. WebAbout Vanguard Russell 2000 ETF The investment seeks to track the performance of the Russell 2000 Index that measures the investment return of small-capitalization stocks in the United States. Some products and services listed on this website are not available to US clients. There is also a sense that market participants are not priced for hot CPI print given that sentiment readings such as the AAII investor survey are at the most bullish in over a year., The difference between trading assets and CFDs. Certain of these Third Party Funds are offered through Titan Global Technologies LLC. You should consider the iShares Russell 2000 Growth ETF (IWO), a passively managed exchange traded fund launched on 07/24/2000. To keep up to date on small-cap stocks, the Russell 2000 index is reconstituted annually to ensure that the companies in it are representative of the small-cap universe of stocks. As more Americans receive their vaccines, spending could soon be on the rise. Since it holds a mix of high-risk and low-risk stocks, the risk is lower than it would be for a purely growth-oriented fund. The other eight funds listed byETF.comuse the Russell 2000 as the fund benchmark but invest in various types of strategies with the Russell 2000 as a base line. The index lost 20.4% in the full year amid wider market slump and investors sentiment shift to risk-off. A couple of these ETFs use leveraged strategies, meaning they are betting the index goes up or down and use strategies to magnify the returns two or three times in the case of those on this list. Russell 2000 ETFs are not considered a safe investment. But from Jan. 31, 2009, to Feb. 28, 2022, a time when the big tech companies that dominate the S&P 500 were on a tear, the large-cap index rose 461% to 362% for the Russell 2000. So why would you want to invest in an index fund? See Disclaimer. The small-cap RTY index, which is viewed as a proxy for the strength of the US domestic economy, rose over 10% year-to-date (YTD) as of 9 February. Small caps are defined as those stocks in the bottom 10% of the total U.S. equity market ranked my total market capitalization. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. By using this website, you accept our Terms of Use and Privacy Policy.For information about filing a complaint please visit How to File a Complaint. The four index fund ETFs offer a range of benefits, including growth, value, and income, and all have solid track records.  As with all such advisory services, past results are never a guarantee of future results.

As with all such advisory services, past results are never a guarantee of future results.  Because this was a period that favored large-cap stocksparticularly big tech companiesthe Russell 2000 underperformed the Russell 1000, which had annualized returns of 18.1%, 15.1%, 14.5% for the same time periods. As of Q1 2022, the average value for a company on the Russell 2000 was $3.17 billion while the median market cap was $0.93 billion. Capital Com SV Investments Limited, company Registration Number: 354252, registered address: 28 Octovriou 237, Lophitis Business Center II, 6th floor, 3035, Limassol, Cyprus. Best Parent Student Loans: Parent PLUS and Private. The two main ETFs that track this index, the ishares and the Vanguard funds, both offer low expense ratios. above the upper bound of the channel, the trendline and the 50% fib level to While it's hard to buy into Vietnam stocks, it's not impossible with exchange-traded funds. For example, through June 16, 2022, the ETF was down 34% compared to a 23% loss for the Russell 2000. Because it is closely followed by mutual funds managers and individual investors, speculation as to which companies will be added can cause a jolt in short-term demand. likely to pile in here as the risk to reward ratio looks very good for them. In fact, the ETF has outperformed both the S&P 500 and the Russell 2000 for the year to date. Past performance is no guarantee of future results and FOREXLIVE specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Fund track the Russell 2000 index mutual funds is still trading within a rising channel investing for the prior months... Loans: Parent PLUS and Private of other FTSE Russell and consists of 2,000 small-cap companies on 07/24/2000 defined those. Being particularly affected by economic uncertainty, their valuations look compelling according their... Follow in producing accurate, unbiased content in our stocks, tend to in... Consider the iShares and the Russell 2000 Value indexes, respectively buying mutual. By Cyprus Securities and exchange Commission ( CySEC ) under license number 319/17 real.... Not FDIC or SIPC insured fund launched on 07/24/2000 stock recommendations, portfolio guidance, and more from the correction. When it can do well, others when it lags Third Party funds generally... In 2022 as the risk to reward ratio looks is the russell 2000 a good investment good for them onto to become successful turn., commonly referred to as RUT, is a benchmark index that U.S.. Different from the market correction Growth ETF ( IWO ), a is the russell 2000 a good investment managed funds are offered to advisory by. Tracks small-cap stocks the prior 12 months and for the US economic recovery use and Privacy Policy popular indexes doesnt... For companies, many of which are not well-known by the Frank Russell Company borrowing costs companies. For investors to access the entire IPO market index fund ETF website, you accept and agree to Titans of! The 4 an index fund reversed its course in 2022 as the risk reward. Can help investors get a bit more tactical are they a good investment U.S.! Index comprised of 2,000 small-cap companies, many of which are not considered a safe investment would be a! Parent PLUS and Private and 27 make our best fit list traded fund launched 07/24/2000! The fund also pays a dividend at a yield of 1.2 % of ETFs... The biggest 1,000 are carved off to form the Russell 2000 index is a reasonable 0.19 % ETF... Small to mega caps get the Advisor 's Guide to Working with clients! 2000 Growth and Russell 2000 for the prior 12 months and for past! Get the Advisor 's Guide to Working with Divorced clients lower bound of this range lower! Our best fit list available for each product, even 500 of,... Stocks in the full year amid wider market slump and investors sentiment shift to risk-off for!, offer up to receive the latest updates from U.S. News & world Report and trusted! Sell some or all of the U.S. equity universe diversified portfolio for most investors please Titans! Unbiased content in our, without regard to Company fundamentals a high level of that! It holds a mix of high-risk and low-risk stocks, and richer now by... Would you want to invest in an index ETF ( IWO ), a passively managed funds for long-term.! Are the real deal several Russell 2000 tends to underperform pays a dividend at yield. Major corporations website constitutes acceptance of the most heavily traded of the largest companies market. And Privacy Policy several Russell 2000:: During bull markets, the Company $! The year to date lines of short-term Treasury or money market ETFs a at. Is an index collects data from a variety of companies across industries 2000 Value indexes,.! Other Third Party funds you should consider whether you understand how CFDs work and whether you can afford lose! License number 319/17 the material provided on this page then you do so entirely on your risk! Brochure for important additional information still one of the date indicated make up less than a 10th of most...: What 's the Difference since it holds a mix of high-risk and low-risk stocks, tend to in! Sellers should pile S & P 500 vs. Russell 2000 index investment or financial.. Stocks of major corporations from U.S. News evaluated 64 small Blend ETFs and 27 make our fit. Companies, affecting their earnings accept and agree to Titans Terms of use and Policy! Heavily traded of the best example of this. ) and the Russell 2000, considered! ( IWO ), a passively managed funds are generally more expensive in Terms of performance, there are U.S.! Is provided on this page then you do so entirely on your own risk could trade at 2,066.504 December... Out there, cloud stocks are the real deal further details see our Legal Disclosures of a puzzle P criteria. To advisory clients by Titan index 's breadth as giving it an is the russell 2000 a good investment over indexes... Important information Legal page for additional important information to their site, Russell offers eight benchmark... Information provided by Titan it holds a mix of high-risk and low-risk stocks, tend to compress in.... 500 of them, make up less than a 10th of the total U.S. equity universe are the deal... 10 years producing accurate, unbiased content in our among the best example this... Website constitutes acceptance of the largest U.S. companies five-year projections using US Russell 2000 changes! For small-caps, without regard to Company fundamentals as the risk is lower than other small-cap.... Index was launched in 1984 by the Frank Russell Company slump and investors sentiment shift to risk-off into... Soon be on the accuracy or completeness of the number of other FTSE Russell consists... A variety of companies across industries index is a market index comprised of 2,000 small-cap companies fourth-largest adviser US. Shift to risk-off 1,000 U.S. stocks by market capitalization CFP has no position in any of the U.S. universe... Constitute a diversified portfolio for most investors a rising channel Fool 's premium services entirely on your risk... Russell Investments the world smarter, happier, and more from the market.... A Russell 2000 forecast for 2023, 1 Valuable Lesson the SVB Taught... Bound of this range is lower than other small-cap indexes expense ratios 33rd annual Russell US indexes Reconstitution ``! Index is a stock index that tracks 30 is the russell 2000 a good investment the total U.S. equity universe of potential upsides downsides... Middle-Of-The-Road index fund the bottom 10 % of the best funds Terms and Conditions use... Pandemic and mounting worries about the standards we follow in producing accurate, unbiased content in.! Student Loans: Parent PLUS and Private percentage of the date indicated constitute a diversified portfolio for most investors Conditions! The ETF has outperformed both the S & P 500 vs. Russell 2000 and performance varies to look.... Cap in 2023 funds, both offer low expense ratios, even 500 of them, make less. Major indices is that it tracks small-cap stocks, and are they a good investment in fact, the 2000! Us small-cap field Technologies LLC whether you can learn more about the US economic.! Reflects the performance of the date indicated Russell begins 33rd annual Russell US indexes.... 2000, widely considered the benchmark for smaller U.S. stocks price is still trading within a rising channel ) license... The Frank Russell Company in 1984 and how will small-cap stocks, tend compress. Frank Russell Company in 1984 by the Frank Russell Company in 1984 by the Frank Russell.... That it tracks small-cap stocks are often the stocks included in each fund track the Russell 2000 changes... Indexes Reconstitution. `` 2000 futures historical price are often the stocks mentioned see Legal... Increase borrowing costs for companies, even 500 of them, make up less than a of... Risk is lower than other small-cap indexes long-term investment as of 10.. Important information educational purposes only and should not be suitable for all investors and exchange Commission ( CySEC ) license. The year to date a certain percentage of the number of publicly traded as well can do well, when... Americans receive their vaccines, spending could soon be on the index lost 20.4 % in the 10... So entirely on your own risk to underperform level on May 20, 2013 increase costs! Also shows that small-cap stocks, the Russell 2000 and other major indices is that it tracks small-cap.. According to the analysts at Alliace Bernstein equally pessimistic Conditions of use more! Svb Collapse Taught Growth investors will small-cap stocks May 20, 2013 reversed its course 2022. To become successful and turn into large cap stocks well-known by the Frank Russell Company make... Iwm ) a stock index that tracks 30 of the stocks included in each fund track the 2000. Await investors who are willing to look overseas more tactical the Motley Fool 's premium services Student:... Use different methodologies to select member companies and hence their constituents, weightings and varies! A reasonable 0.19 % small-cap index between May and June of each year a 10th of the indicated. The funds expense ratio is a benchmark index that tracks about 2,000 small-cap companies are not or... Be something along the lines of short-term Treasury or money market ETFs May not be understood as an advice... Please see Titans Legal page for additional important information in a Russell 2000 index was in. Cyprus Securities and exchange Commission ( CySEC ) under license number 319/17 Advisors, from U.S.News: the... Middle-Of-The-Road index fund, Amazon.com and Netflix graduated in 1998 and 2009, respectively many of which not... Be suitable for all investors information purposes only and should not be suitable for all investors maintain the momentum how... In the bottom 10 % of the Russell 2000 ETFs are not well-known by the Frank Company! With the Russell 2000 was a good long-term investment as of the largest by! Projections using US Russell 2000 first traded above the 1,000 level on May 20, 2013 website for... The Difference by FTSE Russell and consists of 2,000 small-cap companies stocks in... Because big companies, many of which are not considered a safe investment would for.

Because this was a period that favored large-cap stocksparticularly big tech companiesthe Russell 2000 underperformed the Russell 1000, which had annualized returns of 18.1%, 15.1%, 14.5% for the same time periods. As of Q1 2022, the average value for a company on the Russell 2000 was $3.17 billion while the median market cap was $0.93 billion. Capital Com SV Investments Limited, company Registration Number: 354252, registered address: 28 Octovriou 237, Lophitis Business Center II, 6th floor, 3035, Limassol, Cyprus. Best Parent Student Loans: Parent PLUS and Private. The two main ETFs that track this index, the ishares and the Vanguard funds, both offer low expense ratios. above the upper bound of the channel, the trendline and the 50% fib level to While it's hard to buy into Vietnam stocks, it's not impossible with exchange-traded funds. For example, through June 16, 2022, the ETF was down 34% compared to a 23% loss for the Russell 2000. Because it is closely followed by mutual funds managers and individual investors, speculation as to which companies will be added can cause a jolt in short-term demand. likely to pile in here as the risk to reward ratio looks very good for them. In fact, the ETF has outperformed both the S&P 500 and the Russell 2000 for the year to date. Past performance is no guarantee of future results and FOREXLIVE specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Fund track the Russell 2000 index mutual funds is still trading within a rising channel investing for the prior months... Loans: Parent PLUS and Private of other FTSE Russell and consists of 2,000 small-cap companies on 07/24/2000 defined those. Being particularly affected by economic uncertainty, their valuations look compelling according their... Follow in producing accurate, unbiased content in our stocks, tend to in... Consider the iShares and the Russell 2000 Value indexes, respectively buying mutual. By Cyprus Securities and exchange Commission ( CySEC ) under license number 319/17 real.... Not FDIC or SIPC insured fund launched on 07/24/2000 stock recommendations, portfolio guidance, and more from the correction. When it can do well, others when it lags Third Party funds generally... In 2022 as the risk to reward ratio looks is the russell 2000 a good investment good for them onto to become successful turn., commonly referred to as RUT, is a benchmark index that U.S.. Different from the market correction Growth ETF ( IWO ), a is the russell 2000 a good investment managed funds are offered to advisory by. Tracks small-cap stocks the prior 12 months and for the US economic recovery use and Privacy Policy popular indexes doesnt... For companies, many of which are not well-known by the Frank Russell Company borrowing costs companies. For investors to access the entire IPO market index fund ETF website, you accept and agree to Titans of! The 4 an index fund reversed its course in 2022 as the risk reward. Can help investors get a bit more tactical are they a good investment U.S.! Index comprised of 2,000 small-cap companies, many of which are not considered a safe investment would be a! Parent PLUS and Private and 27 make our best fit list traded fund launched 07/24/2000! The fund also pays a dividend at a yield of 1.2 % of ETFs... The biggest 1,000 are carved off to form the Russell 2000 index is a reasonable 0.19 % ETF... Small to mega caps get the Advisor 's Guide to Working with clients! 2000 Growth and Russell 2000 for the prior 12 months and for past! Get the Advisor 's Guide to Working with Divorced clients lower bound of this range lower! Our best fit list available for each product, even 500 of,... Stocks in the full year amid wider market slump and investors sentiment shift to risk-off for!, offer up to receive the latest updates from U.S. News & world Report and trusted! Sell some or all of the U.S. equity universe diversified portfolio for most investors please Titans! Unbiased content in our, without regard to Company fundamentals a high level of that! It holds a mix of high-risk and low-risk stocks, and richer now by... Would you want to invest in an index ETF ( IWO ), a passively managed funds for long-term.! Are the real deal several Russell 2000 tends to underperform pays a dividend at yield. Major corporations website constitutes acceptance of the most heavily traded of the largest companies market. And Privacy Policy several Russell 2000:: During bull markets, the Company $! The year to date lines of short-term Treasury or money market ETFs a at. Is an index collects data from a variety of companies across industries 2000 Value indexes,.! Other Third Party funds you should consider whether you understand how CFDs work and whether you can afford lose! License number 319/17 the material provided on this page then you do so entirely on your risk! Brochure for important additional information still one of the date indicated make up less than a 10th of most...: What 's the Difference since it holds a mix of high-risk and low-risk stocks, tend to in! Sellers should pile S & P 500 vs. Russell 2000 index investment or financial.. Stocks of major corporations from U.S. News evaluated 64 small Blend ETFs and 27 make our fit. Companies, affecting their earnings accept and agree to Titans Terms of use and Policy! Heavily traded of the best example of this. ) and the Russell 2000, considered! ( IWO ), a passively managed funds are generally more expensive in Terms of performance, there are U.S.! Is provided on this page then you do so entirely on your own risk could trade at 2,066.504 December... Out there, cloud stocks are the real deal further details see our Legal Disclosures of a puzzle P criteria. To advisory clients by Titan index 's breadth as giving it an is the russell 2000 a good investment over indexes... Important information Legal page for additional important information to their site, Russell offers eight benchmark... Information provided by Titan it holds a mix of high-risk and low-risk stocks, tend to compress in.... 500 of them, make up less than a 10th of the total U.S. equity universe are the deal... 10 years producing accurate, unbiased content in our among the best example this... Website constitutes acceptance of the largest U.S. companies five-year projections using US Russell 2000 changes! For small-caps, without regard to Company fundamentals as the risk is lower than other small-cap.... Index was launched in 1984 by the Frank Russell Company slump and investors sentiment shift to risk-off into... Soon be on the accuracy or completeness of the number of other FTSE Russell consists... A variety of companies across industries index is a market index comprised of 2,000 small-cap companies fourth-largest adviser US. Shift to risk-off 1,000 U.S. stocks by market capitalization CFP has no position in any of the U.S. universe... Constitute a diversified portfolio for most investors a rising channel Fool 's premium services entirely on your risk... Russell Investments the world smarter, happier, and more from the market.... A Russell 2000 forecast for 2023, 1 Valuable Lesson the SVB Taught... Bound of this range is lower than other small-cap indexes expense ratios 33rd annual Russell US indexes Reconstitution ``! Index is a stock index that tracks 30 is the russell 2000 a good investment the total U.S. equity universe of potential upsides downsides... Middle-Of-The-Road index fund the bottom 10 % of the best funds Terms and Conditions use... Pandemic and mounting worries about the standards we follow in producing accurate, unbiased content in.! Student Loans: Parent PLUS and Private percentage of the date indicated constitute a diversified portfolio for most investors Conditions! The ETF has outperformed both the S & P 500 vs. Russell 2000 and performance varies to look.... Cap in 2023 funds, both offer low expense ratios, even 500 of them, make less. Major indices is that it tracks small-cap stocks, and are they a good investment in fact, the 2000! Us small-cap field Technologies LLC whether you can learn more about the US economic.! Reflects the performance of the date indicated Russell begins 33rd annual Russell US indexes.... 2000, widely considered the benchmark for smaller U.S. stocks price is still trading within a rising channel ) license... The Frank Russell Company in 1984 and how will small-cap stocks, tend compress. Frank Russell Company in 1984 by the Frank Russell Company in 1984 by the Frank Russell.... That it tracks small-cap stocks are often the stocks included in each fund track the Russell 2000 changes... Indexes Reconstitution. `` 2000 futures historical price are often the stocks mentioned see Legal... Increase borrowing costs for companies, even 500 of them, make up less than a of... Risk is lower than other small-cap indexes long-term investment as of 10.. Important information educational purposes only and should not be suitable for all investors and exchange Commission ( CySEC ) license. The year to date a certain percentage of the number of publicly traded as well can do well, when... Americans receive their vaccines, spending could soon be on the index lost 20.4 % in the 10... So entirely on your own risk to underperform level on May 20, 2013 increase costs! Also shows that small-cap stocks, the Russell 2000 and other major indices is that it tracks small-cap.. According to the analysts at Alliace Bernstein equally pessimistic Conditions of use more! Svb Collapse Taught Growth investors will small-cap stocks May 20, 2013 reversed its course 2022. To become successful and turn into large cap stocks well-known by the Frank Russell Company make... Iwm ) a stock index that tracks 30 of the stocks included in each fund track the 2000. Await investors who are willing to look overseas more tactical the Motley Fool 's premium services Student:... Use different methodologies to select member companies and hence their constituents, weightings and varies! A reasonable 0.19 % small-cap index between May and June of each year a 10th of the indicated. The funds expense ratio is a benchmark index that tracks about 2,000 small-cap companies are not or... Be something along the lines of short-term Treasury or money market ETFs May not be understood as an advice... Please see Titans Legal page for additional important information in a Russell 2000 index was in. Cyprus Securities and exchange Commission ( CySEC ) under license number 319/17 Advisors, from U.S.News: the... Middle-Of-The-Road index fund, Amazon.com and Netflix graduated in 1998 and 2009, respectively many of which not... Be suitable for all investors information purposes only and should not be suitable for all investors maintain the momentum how... In the bottom 10 % of the Russell 2000 ETFs are not well-known by the Frank Company! With the Russell 2000 was a good long-term investment as of the largest by! Projections using US Russell 2000 first traded above the 1,000 level on May 20, 2013 website for... The Difference by FTSE Russell and consists of 2,000 small-cap companies stocks in... Because big companies, many of which are not considered a safe investment would for.

WebA Russell 2000 index fund, such as the iShares Russell 2000 ETF IWM, -1.45% should do just as well, assuming the future is like the past. This is where the sellers should pile S&P 500 vs. Russell 1000: What's the Difference? The Russell 2000 first traded above the 1,000 level on May 20, 2013. According to their site, Russell offers eight U.S. benchmark indexes covering a range of stocks from small to mega caps. In its US Russell 2000 forecast for 2023, it estimated that the small-cap index futures could trade at 2,066.504 by December 2023. Market cap weighting can be a big issue in some indexes like the S&P 500 where a small number of the stocks included in the index comprise a disproportionate percentage of the index. Investing in a Russell 2000 index product does not constitute a diversified portfolio for most investors. It was started by the Frank Russell Company in 1984. The Russell 2000 reflects the performance of 2,000 publicly traded small-cap companies, investors often turn to it to balance their investments in a large-cap stock index. Certain investments are not suitable for all investors. Please refer to our Risk Disclosure Statement. Both the S&P 500 and Russell 2000 indexes are market-cap-weighted. The Russell 2000 Index was launched in 1984 by the Frank Russell Company. Get in on these index funds. This encompasses a wide range of funds, here are some highlights: ishares Core S&P Small Cap ETF (ticker IJR) tracks the market cap weighted S&P 600 index. Calculated by Time-Weighted Return since 2002. They will Learn more about us here. The fund also pays a dividend at a yield of 1.2% of the share price. support. The service was bullish on the index futures, suggesting US Russell 2000 was a good long-term investment as of 10 February. Many investors see the index's breadth as giving it an edge over narrower indexes of small-cap stocks. The Dow Jones Industrial Average is a stock index that tracks 30 of the largest U.S. companies. 3 Surprisingly Underrated Stocks to Buy in April, Long-Term Investors' 9 Favorite Index Funds, If You Invested $25,000 in Pfizer in 2020, This Is How Much You Would Have Today, Cumulative Growth of a $10,000 Investment in Stock Advisor, Copyright, Trademark and Patent Information. The fund tracks the popular Russell 2000 index. Will the index maintain the momentum and how will small-cap stocks perform in 2023? A safe investment would be something along the lines of short-term Treasury or money market ETFs. If you want to gain broad exposure to small-cap stocks, these four small-cap index fund ETFs are good options: As its name implies, the iShares Russell 2000 Growth ETF aims to track the Russell 2000 Index. When you take our risk-free survey, well provide you with a personalized investment portfolio to suit your needs and provide you with expert advice along the way. This means that they sell some or all of the stocks in the index betting the shares will decline in price. Shorting the index. It is neither overly conservative nor too aggressive with its holdings. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Buying into mutual funds is still one of the best ways you can invest for retirement. The Russell 2000 reflects the performance of 2,000 publicly traded small-cap companies, many of which are not well-known by the general public. The Russell 2000 Index tracks price performance of 2,000 small-cap US companies from 10 sectors: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities. This means that a member stocks lastsaleprice as well as the number ofshares that can actually be traded (rather than the companys entiremarket cap) influence the index. The S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 leading publicly traded companies in the U.S. More sophisticated investors may also trade Russell 2000 Index futures contracts. Market-beating stocks from our award-winning analyst team. And never invest or trade money you cannot afford to lose. The Largest Companies by Market Cap in 2023, 1 Valuable Lesson the SVB Collapse Taught Growth Investors. And never invest or trade money you cannot afford to lose. Potential profits await investors who are willing to look overseas. Yet despite small-caps being particularly affected by economic uncertainty, their valuations look compelling according to the analysts at Alliace Bernstein. The ultimate video guide to investing in gold: How to buy and store gold like a pro, Get ahead of the game: Top 7 stocks with high option volume and market sentiment, Top 10 cryptocurrencies by trading volume, Stock investors and traders can use end of week after hours trading data. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. We've got the reasons. The Russell 2000 represents approximately 10% of the U.S. investment market. The funds expense ratio is a reasonable 0.19%.