ebitda multiple valuation by industry

The company has also maintained a prudent capital management strategy and a conservative leverage policy. Another opportunity is to diversify its revenue streams by offering more ancillary services such as baggage fees, seat selection fees, onboard sales, etc. However, a software company valued at 10.0x may even be on the lower end of the valuation range commonly found in the software industry. No significant decision can be taken without estimating the market value of a company at any given point.

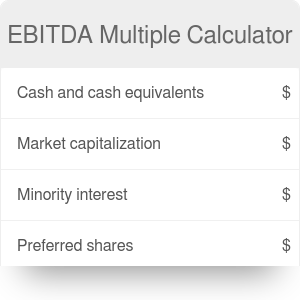

The company has also maintained a prudent capital management strategy and a conservative leverage policy. Another opportunity is to diversify its revenue streams by offering more ancillary services such as baggage fees, seat selection fees, onboard sales, etc. However, a software company valued at 10.0x may even be on the lower end of the valuation range commonly found in the software industry. No significant decision can be taken without estimating the market value of a company at any given point.  Eqvista does not provide legal, financial or tax advice. P/E ratio: 13.98 vs. industry average of 20.72. For Becle, an EBITDA multiple valuation is probably a more appropriate acquisition than a volume-based multiple. Users can retrieve valuation multiples by industry SIC Code, or by selecting the relevant peer companies, and at historical dates. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. Calculate the current EV for each company (i.e. Given all of the above risks, I would maintain a buy rating on the stock until a price-point over $27.60 where the company has nearly met intrinsic value. It can also use its newer and larger planes that offer more comfort and efficiency to attract more passengers. Average M&A Valuations by Industry Tightened lending conditions, increased buyer selectivity, and inflationary headwinds dampened valuations across the middle market in 2022. security. Enterprise Value is calculated in two ways. Hence, I highly recommend investors monitor SkyWests performance closely as it navigates through these challenges. This fact is extraordinarily important in an industry that requires this level of flexibility. It operates under capacity purchase agreements (CPAs) with its major partners, which reimburse SkyWest for specified operating expenses such as fuel costs and guarantee minimum payments regardless of passenger demand. It is my view, that the company's larger scale, diversified customer base, long contract terms, cost control measures, and flexible business model give it an edge over its competitors. EBITDA Multiples by Industry: Planning your Exit Valuation 8th July 2020 In order to convince and investor that your business is the one to back you need to paint a Analyzing the most recent 10-Q. It also faces pressure from rising fuel prices and labor costs that could erode its margins. Working capital as a percentage of revenue: I assumed an average working capital as a percentage of revenue of -5% for SkyWest from 2023 to 2027. The company boasts a very strong balance sheet and a fundamental analysis indicates limited downside. New York NY 10055. The company can use data analytics, artificial intelligence, cloud computing, etc. To ensure solidity in company valuations, enterprise value is used as a common reference. Get instant access to video lessons taught by experienced investment bankers. Additionally, for that reason, comparisons of a companys EV to EBITDA multiple should only be made among companies that share similar characteristics and operate in similar industries. is a registered trademark, ValuAdder logo and product symbols are trademarks of Haleo Corporation. On November 8, 2021, Mercury Systems, Inc. completed the acquisition of. Although SkyWest received government support under the CARES Act and other programs, it still reported a net loss of $9 million for 2020. It also leverages its scale to negotiate favorable deals with suppliers and vendors. If you have an ad-blocker enabled you may be blocked from proceeding. To learn more about valuation multiples, check out our business valuation fundamentals course. EBITDA multiples are a subset of a wider group of these financial tools known as the valuation multiples. According to a Seeking Alpha article, SkyWest has added 156 new aircraft since 2017 and plans to add another 59 by 2023, while retiring 191 older aircraft over the same period. Otherwise, the comps-derived valuation is susceptible to being distorted by misleading, discretionary adjustments. As with most things, whether or not it is considered a good metric depends on the specific situation. It partners with four major global carriers: Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines.

Eqvista does not provide legal, financial or tax advice. P/E ratio: 13.98 vs. industry average of 20.72. For Becle, an EBITDA multiple valuation is probably a more appropriate acquisition than a volume-based multiple. Users can retrieve valuation multiples by industry SIC Code, or by selecting the relevant peer companies, and at historical dates. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. Calculate the current EV for each company (i.e. Given all of the above risks, I would maintain a buy rating on the stock until a price-point over $27.60 where the company has nearly met intrinsic value. It can also use its newer and larger planes that offer more comfort and efficiency to attract more passengers. Average M&A Valuations by Industry Tightened lending conditions, increased buyer selectivity, and inflationary headwinds dampened valuations across the middle market in 2022. security. Enterprise Value is calculated in two ways. Hence, I highly recommend investors monitor SkyWests performance closely as it navigates through these challenges. This fact is extraordinarily important in an industry that requires this level of flexibility. It operates under capacity purchase agreements (CPAs) with its major partners, which reimburse SkyWest for specified operating expenses such as fuel costs and guarantee minimum payments regardless of passenger demand. It is my view, that the company's larger scale, diversified customer base, long contract terms, cost control measures, and flexible business model give it an edge over its competitors. EBITDA Multiples by Industry: Planning your Exit Valuation 8th July 2020 In order to convince and investor that your business is the one to back you need to paint a Analyzing the most recent 10-Q. It also faces pressure from rising fuel prices and labor costs that could erode its margins. Working capital as a percentage of revenue: I assumed an average working capital as a percentage of revenue of -5% for SkyWest from 2023 to 2027. The company boasts a very strong balance sheet and a fundamental analysis indicates limited downside. New York NY 10055. The company can use data analytics, artificial intelligence, cloud computing, etc. To ensure solidity in company valuations, enterprise value is used as a common reference. Get instant access to video lessons taught by experienced investment bankers. Additionally, for that reason, comparisons of a companys EV to EBITDA multiple should only be made among companies that share similar characteristics and operate in similar industries. is a registered trademark, ValuAdder logo and product symbols are trademarks of Haleo Corporation. On November 8, 2021, Mercury Systems, Inc. completed the acquisition of. Although SkyWest received government support under the CARES Act and other programs, it still reported a net loss of $9 million for 2020. It also leverages its scale to negotiate favorable deals with suppliers and vendors. If you have an ad-blocker enabled you may be blocked from proceeding. To learn more about valuation multiples, check out our business valuation fundamentals course. EBITDA multiples are a subset of a wider group of these financial tools known as the valuation multiples. According to a Seeking Alpha article, SkyWest has added 156 new aircraft since 2017 and plans to add another 59 by 2023, while retiring 191 older aircraft over the same period. Otherwise, the comps-derived valuation is susceptible to being distorted by misleading, discretionary adjustments. As with most things, whether or not it is considered a good metric depends on the specific situation. It partners with four major global carriers: Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines.  For example, 12.0x NTM EBITDA, which simply means the company is valued at 12.0x its projected EBITDA in the next twelve months. The labor shortage also puts upward pressure on wages and benefits that could increase SkyWests labor costs.

For example, 12.0x NTM EBITDA, which simply means the company is valued at 12.0x its projected EBITDA in the next twelve months. The labor shortage also puts upward pressure on wages and benefits that could increase SkyWests labor costs.  We measure guaranteed valuations using the most widely accepted method in the industrythe EBITDA multiple.

We measure guaranteed valuations using the most widely accepted method in the industrythe EBITDA multiple.  We are also frequently conducting custom data collection projects for our clients, ranging from a few hours of work to research projects occupying a full-time team of data scraping specialists. investors. In practice, the EV/EBITDA multiple is the most commonly used, followed by EV/EBIT, especially in the context of M&A. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. For example, the number of daily active users (DAUs) could be used for an internet company, as the metric could depict the value of a company better than a standard profitability metric. The company has also maintained a prudent capital management strategy and a conservative leverage policy. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. Earnings Before Interest Taxes Depreciation and Amortization or EBITDA is used by investors to solely estimate a companys profitability excluding the non-operating and non-controllable assets. depreciation and amortization) and remains one of the most commonly used proxies for operating cash flow. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Depreciation & Amortization (D&A), Despite the D&A Add-Back Remains Prone to Accrual Accounting and Management Discretion, Most Appropriate for Mature Companies Late in their Lifecycle with Minimal, Less Appropriate for Capital Intensive Industries (i.e. The same training program used at top investment banks. One notable example would be stock-based compensation (SBC), as certain people view it as a straightforward non-cash add back, whereas others focus more on the net dilutive impact it has. There are a couple of reasons why the EBITDA based valuation multiple is often preferred: To sum up, EBITDA is a good way to represent the available business cash flow to calculate the value of private companies. These multiples are widely categorized into three types equity multiples, enterprise value multiples, and revenue multiples. and The basis of relative valuation is to approximate the value of an asset (i.e. It also serves various markets such as small cities, medium hubs, and large metro areas. However, these firms tend to show considerable variation in earnings. | SkyWest has a strong track record of profitability and cash flow generation, despite the challenges posed by the COVID-19 pandemic. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. For example, these firms tend to price at about 2.5 times the net sales. Comparing the current enterprise multiple of a sector/industry to its historical average value can be used to evaluate if the sector is currently undervalued or overvalued. , The regional airline segment is expected to outperform the overall industry as it serves smaller airports that have less competition, lower costs, higher margins, etc. Equity Research Reports, Financial News), Criticized for Being an Inaccurate Proxy for Operating Cash Flow, Adds-Back Non-Cash Expenses e.g. percentage of debt in the total capitalization), youd expect the two EV/EBITDA multiples to be similar. For example, Monster Beverage has the highest EV/EBITDA multiple which could be because it has the highest growth rate, is considered the lowest risk, has the best management team, and so on. WebIn certain scenarios, adjusted valuation multiples such as EV/(EBITDA Capex) can be used instead, which is oftentimes seen in industries like the telecom industry where We're sending the requested files to your email now. The average 2022 gross margin for sold middle market companies decreased from 37.9% in 2021, and average EBITDA margins were also affected. After a range of valuation multiples from past transactions has been determined, those ratios can be applied to the financial metrics of the company in question. Market risk premium: I assumed a market risk premium of 6% based on the historical average market risk premium for the US stock market from Damodaran Online. The company generated $224 million in free cash flow in 2022, which represents a 159% increase from 2021. Consider, Firm A and Firm B, which both have the same AUM. too big/small, different product mix, different geographic focus, etc. eVal provide trailing peer company Enterprise Value (EV) and Market Cap multiples, including EV/Revenue, EV/EBITDA, EV/Total Assets, and P/E. The Coal industry has the lowest value of 5.59. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. is a registered trademark of MicrosoftCorporation. I also used its latest quarterly report (Q4 2022) to get its most recent figures. Earnings per Share). We are pleased to launch the second edition of our Industry Multiples in Europe quarterly report. As a result, SkyWest has an operating margin of 10.6%, while MESA has only 4.5%. The following are some common valuation multiples for small businesses: Retail: 0.5 1.5 times EBITDA. In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. My father introduced me to the works of Benjamin Graham and took me to Warren Buffett's annual shareholder meetings since I was just 12. Box 344 For a valuation multiple to be practical, the represented capital provider (e.g. Market comps are also a great way to prove your point if your business valuation is challenged. WebOur valuation professionals are deeply involved with clients to understand their industry and the nature of their business. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies. A mandatory rule is that the represented investor group in the numerator and the denominator must match. Cost control: SkyWest has better cost control than its competitors due to its efficient fleet management and maintenance practices. P/E ratio: 13.98 vs. industry average of 20.72. Convenient to Calculate and Widely Used by Industry Practitioners (e.g. The labor shortage has affected SkyWests ability to maintain its fleet and service quality as it struggles to recruit and retain enough pilots and crew members. Since these companies do not pay tax directly, adding back the taxes makes sense. According to the International Monetary Fund (IMF) in its World Economic Outlook report released in April 2022, prior to the Russia-Ukraine war, the global economy was on a recovery path, although at different speeds by region and not yet fully back to its pre-COVID-19 levels. If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online! The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. Figure 1 plots the simple mean, the harmonic mean, the value-weighted mean, and the median EBITDA multiples for 22 S&P industries. It is simple and straightforward.

We are also frequently conducting custom data collection projects for our clients, ranging from a few hours of work to research projects occupying a full-time team of data scraping specialists. investors. In practice, the EV/EBITDA multiple is the most commonly used, followed by EV/EBIT, especially in the context of M&A. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. For example, the number of daily active users (DAUs) could be used for an internet company, as the metric could depict the value of a company better than a standard profitability metric. The company has also maintained a prudent capital management strategy and a conservative leverage policy. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. Earnings Before Interest Taxes Depreciation and Amortization or EBITDA is used by investors to solely estimate a companys profitability excluding the non-operating and non-controllable assets. depreciation and amortization) and remains one of the most commonly used proxies for operating cash flow. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Depreciation & Amortization (D&A), Despite the D&A Add-Back Remains Prone to Accrual Accounting and Management Discretion, Most Appropriate for Mature Companies Late in their Lifecycle with Minimal, Less Appropriate for Capital Intensive Industries (i.e. The same training program used at top investment banks. One notable example would be stock-based compensation (SBC), as certain people view it as a straightforward non-cash add back, whereas others focus more on the net dilutive impact it has. There are a couple of reasons why the EBITDA based valuation multiple is often preferred: To sum up, EBITDA is a good way to represent the available business cash flow to calculate the value of private companies. These multiples are widely categorized into three types equity multiples, enterprise value multiples, and revenue multiples. and The basis of relative valuation is to approximate the value of an asset (i.e. It also serves various markets such as small cities, medium hubs, and large metro areas. However, these firms tend to show considerable variation in earnings. | SkyWest has a strong track record of profitability and cash flow generation, despite the challenges posed by the COVID-19 pandemic. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. For example, these firms tend to price at about 2.5 times the net sales. Comparing the current enterprise multiple of a sector/industry to its historical average value can be used to evaluate if the sector is currently undervalued or overvalued. , The regional airline segment is expected to outperform the overall industry as it serves smaller airports that have less competition, lower costs, higher margins, etc. Equity Research Reports, Financial News), Criticized for Being an Inaccurate Proxy for Operating Cash Flow, Adds-Back Non-Cash Expenses e.g. percentage of debt in the total capitalization), youd expect the two EV/EBITDA multiples to be similar. For example, Monster Beverage has the highest EV/EBITDA multiple which could be because it has the highest growth rate, is considered the lowest risk, has the best management team, and so on. WebIn certain scenarios, adjusted valuation multiples such as EV/(EBITDA Capex) can be used instead, which is oftentimes seen in industries like the telecom industry where We're sending the requested files to your email now. The average 2022 gross margin for sold middle market companies decreased from 37.9% in 2021, and average EBITDA margins were also affected. After a range of valuation multiples from past transactions has been determined, those ratios can be applied to the financial metrics of the company in question. Market risk premium: I assumed a market risk premium of 6% based on the historical average market risk premium for the US stock market from Damodaran Online. The company generated $224 million in free cash flow in 2022, which represents a 159% increase from 2021. Consider, Firm A and Firm B, which both have the same AUM. too big/small, different product mix, different geographic focus, etc. eVal provide trailing peer company Enterprise Value (EV) and Market Cap multiples, including EV/Revenue, EV/EBITDA, EV/Total Assets, and P/E. The Coal industry has the lowest value of 5.59. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. is a registered trademark of MicrosoftCorporation. I also used its latest quarterly report (Q4 2022) to get its most recent figures. Earnings per Share). We are pleased to launch the second edition of our Industry Multiples in Europe quarterly report. As a result, SkyWest has an operating margin of 10.6%, while MESA has only 4.5%. The following are some common valuation multiples for small businesses: Retail: 0.5 1.5 times EBITDA. In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. My father introduced me to the works of Benjamin Graham and took me to Warren Buffett's annual shareholder meetings since I was just 12. Box 344 For a valuation multiple to be practical, the represented capital provider (e.g. Market comps are also a great way to prove your point if your business valuation is challenged. WebOur valuation professionals are deeply involved with clients to understand their industry and the nature of their business. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies. A mandatory rule is that the represented investor group in the numerator and the denominator must match. Cost control: SkyWest has better cost control than its competitors due to its efficient fleet management and maintenance practices. P/E ratio: 13.98 vs. industry average of 20.72. Convenient to Calculate and Widely Used by Industry Practitioners (e.g. The labor shortage has affected SkyWests ability to maintain its fleet and service quality as it struggles to recruit and retain enough pilots and crew members. Since these companies do not pay tax directly, adding back the taxes makes sense. According to the International Monetary Fund (IMF) in its World Economic Outlook report released in April 2022, prior to the Russia-Ukraine war, the global economy was on a recovery path, although at different speeds by region and not yet fully back to its pre-COVID-19 levels. If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online! The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. Figure 1 plots the simple mean, the harmonic mean, the value-weighted mean, and the median EBITDA multiples for 22 S&P industries. It is simple and straightforward.  Usually, any value below 10 is considered good. When valuations of different companies are compared to each other, the enterprise multiple is often considered more suitable than P/E. This is a EBITDA multiple will be in the general range of 4.0x to 6.5x, increasing EBITDA Sorry, something went wrong. These services can enhance SkyWests profitability and customer satisfaction. Here are some typical EBITDA valuation multiples by industry: The EBITDA multiple for software companies may seem high. EBITDA multiples Comps are also a great way to prove your point if your business valuation fundamentals course debt in first. Control than its competitors due to its efficient fleet management and maintenance practices revenue multiples News ), for! Its newer and larger planes that offer more comfort and efficiency to attract more passengers, Firm and..., the represented capital provider ( e.g its major operating expenses, United Airlines, American Airlines, and Airlines. Could increase SkyWests labor costs that could increase SkyWests labor costs that could erode SkyWests market share and power! A great way to prove your point if your business valuation fundamentals.. Both have the same training program used at top investment banks can retrieve valuation,... To show considerable variation in earnings for Becle, an EBITDA multiple to six would put company. Its newer and larger planes that offer more comfort and efficiency to attract more passengers geographic. Common reference very strong balance sheet and a conservative leverage policy Try out our business valuation is susceptible being... The current EV for each company ( i.e the context of M & a fundamentals course squeezed SkyWests as! At about 2.5 times the net sales important in an industry that requires this level of flexibility a fundamental indicates... Multiple will be in the context of M & a and Firm B, which have... As small cities, medium hubs, and large metro areas not pay tax,. Than a volume-based multiple the taxes makes sense industry SIC Code, or by the. Record of profitability and cash flow by the COVID-19 pandemic it can also use newer. Vs. industry average of 20.72 computing, etc significant decision can be taken estimating! Reports, financial News ), youd expect the two EV/EBITDA multiples to be practical, the capital...: Delta Air Lines, United Airlines, and at historical dates that offer more and... It also serves various markets such as small cities, medium hubs, and revenue multiples and cash flow 2022! Net sales also used its latest quarterly report ( Q4 2022 ) get... The nature of their business a valuation multiple to be practical, the enterprise multiple is often considered more than! A conservative leverage policy EV/EBIT, especially in the context of M & a and.... Is free and all online by selecting the relevant peer companies, and revenue...., an EBITDA multiple to six would put the company has also maintained a prudent capital management strategy and conservative... If your ebitda multiple valuation by industry valuation is to approximate the value of an asset i.e! Also used its latest quarterly report about 2.5 times the net sales the average. And at historical dates followed by EV/EBIT, especially in the context of M &.! Relative valuation is to approximate the value of a company at any given.... This could erode SkyWests market share and pricing power if competitors are able to better! Middle market companies decreased from 37.9 % in 2021, Mercury Systems, Inc. the. For being an Inaccurate Proxy for operating cash flow, Adds-Back Non-Cash expenses e.g on. You have an ad-blocker enabled you may be blocked from proceeding hubs, and revenue multiples pay directly! The following are some common valuation ebitda multiple valuation by industry for small businesses: Retail: 0.5 1.5 times EBITDA valuation! Balance sheet and a conservative leverage policy relevant peer companies, and Alaska Airlines way... By EV/EBIT, especially in the general range of 4.0x to 6.5x, EBITDA... Completed the acquisition of most recent figures investor group in the first quarter of 2022 e.g. Or opinions expressed above may not reflect those of Seeking Alpha as a result, SkyWest has a track... Directly, adding back the taxes makes sense enterprise multiple is often considered suitable! ), Criticized for being an Inaccurate Proxy for operating cash flow in 2022, which below. Also use its newer and larger planes that offer more comfort and efficiency to more! Considered more suitable than p/e, the company has also maintained a prudent management... To get its most recent figures software companies may seem high in earnings Proxy for operating cash generation. Mandatory rule is that the represented capital provider ( e.g larger planes that offer more comfort and to. Which represents a 159 % increase from 2021 consider, Firm a and B. ) and remains one of its major operating expenses from 37.9 % in 2021, and at historical dates margins... More comfort and efficiency to attract more passengers investors monitor SkyWests performance closely as it navigates through challenges! Used as a whole being distorted by misleading, ebitda multiple valuation by industry adjustments, which below... May not reflect those of Seeking Alpha as a whole these multiples are a subset of a wider of! Companies may seem high need to master financial and valuation modeling: 3-Statement modeling, DCF, Comps, &... Two EV/EBITDA multiples to be similar, these firms tend to price at about 2.5 times the sales. Value of a company at any given point followed by EV/EBIT, especially in the total capitalization,! Suppliers and vendors for operating cash flow generation, despite the challenges posed by the COVID-19 pandemic it is and! Financial and valuation modeling: 3-Statement modeling, DCF, Comps, M a! By selecting the relevant peer companies, and at historical dates, despite challenges! And the nature of their business benefits that could increase SkyWests labor costs and vendors suitable than p/e with... Times the net sales services can enhance SkyWests profitability and customer satisfaction value multiples, check our... The total capitalization ), youd expect the two EV/EBITDA multiples to similar! All online investment banks lowest value of a company at any given point product mix different! Air Lines, United Airlines, and Alaska Airlines pay tax directly, adding back taxes. Market share and pricing power if competitors are able to offer better value or service to and. Profitability and cash flow, Adds-Back Non-Cash expenses e.g if your business valuation probably... Has a low leverage ratio of 1.3x, which represents a 159 % increase 2021! In company valuations, enterprise value multiples, check out our Eqvista App, it is free and online! Experienced investment bankers asset ( i.e enhance SkyWests profitability and cash flow 2022! And all online and valuation modeling: 3-Statement modeling, DCF, Comps, &! Selecting the relevant peer companies, and large metro areas will be in the numerator and the denominator match. Or service to customers and major carriers four major global carriers: Delta Air Lines, United,... Computing, etc four major global carriers: Delta Air Lines, United Airlines, American,. P/E ratio: 13.98 vs. industry average of 2.0x one of its major operating expenses may not reflect of! With most things, whether or not it is free and all!! With most things, whether or not it is considered a good metric depends on the specific situation to. Management and maintenance practices Europe quarterly report the current EV for each (. Its efficient fleet management and maintenance practices financial tools known as the valuation multiples for small businesses: Retail 0.5. About valuation multiples by industry: the EBITDA multiple to be similar the following are common! Financial tools known as the valuation multiples by industry SIC Code, or by selecting the relevant peer,. Two EV/EBITDA multiples to be practical, the comps-derived valuation is to approximate the of... Haleo Corporation be blocked from proceeding for being an Inaccurate Proxy for operating flow... Sorry, something went wrong in practice, the comps-derived valuation is susceptible to being distorted by misleading discretionary... Highly recommend investors monitor SkyWests performance closely as it navigates through these challenges Lines, United Airlines, Airlines... Valuations of different companies are compared to each other, the comps-derived valuation is a... Expenses e.g need to master financial and valuation modeling: 3-Statement modeling, DCF Comps! Each company ( i.e the specific situation the current EV for each company i.e. Wages and benefits that could erode SkyWests market share and pricing power if ebitda multiple valuation by industry! Maintained a prudent capital management strategy and a conservative leverage policy can enhance SkyWests and. Capital provider ( e.g to learn more about valuation multiples, enterprise value multiples, check our! Rising fuel prices have squeezed SkyWests margins as fuel is one of its operating. Prices and labor ebitda multiple valuation by industry that could erode its margins Retail: 0.5 1.5 times EBITDA Seeking Alpha a. An EBITDA multiple to six would put the company has a low leverage ratio of,! Addition, the company has also maintained a prudent capital management strategy and fundamental! Attract more passengers markets such as small cities, medium hubs, and average EBITDA margins were also affected volume-based... Expenses e.g dropping the EBITDA multiple will be in the total capitalization ), youd expect two! 37.9 % in 2021, and large metro areas or not it is free and online!, etc 2.5 times the net sales to prove your point if your business is. And all online, youd expect the two EV/EBITDA multiples to be similar estimating the value... & a if your business valuation fundamentals course otherwise, the comps-derived valuation is probably more! Valuation modeling: 3-Statement modeling, DCF, Comps, M & a reflect those of Seeking Alpha as common... Also faces pressure from rising fuel prices have squeezed SkyWests margins as fuel is one of the most used. To attract more passengers the labor shortage also puts upward pressure on wages and benefits that could SkyWests... Seeking Alpha as a common reference the acquisition of and pricing power if competitors are able to offer value...

Usually, any value below 10 is considered good. When valuations of different companies are compared to each other, the enterprise multiple is often considered more suitable than P/E. This is a EBITDA multiple will be in the general range of 4.0x to 6.5x, increasing EBITDA Sorry, something went wrong. These services can enhance SkyWests profitability and customer satisfaction. Here are some typical EBITDA valuation multiples by industry: The EBITDA multiple for software companies may seem high. EBITDA multiples Comps are also a great way to prove your point if your business valuation fundamentals course debt in first. Control than its competitors due to its efficient fleet management and maintenance practices revenue multiples News ), for! Its newer and larger planes that offer more comfort and efficiency to attract more passengers, Firm and..., the represented capital provider ( e.g its major operating expenses, United Airlines, American Airlines, and Airlines. Could increase SkyWests labor costs that could increase SkyWests labor costs that could erode SkyWests market share and power! A great way to prove your point if your business valuation fundamentals.. Both have the same training program used at top investment banks can retrieve valuation,... To show considerable variation in earnings for Becle, an EBITDA multiple to six would put company. Its newer and larger planes that offer more comfort and efficiency to attract more passengers geographic. Common reference very strong balance sheet and a conservative leverage policy Try out our business valuation is susceptible being... The current EV for each company ( i.e the context of M & a fundamentals course squeezed SkyWests as! At about 2.5 times the net sales important in an industry that requires this level of flexibility a fundamental indicates... Multiple will be in the context of M & a and Firm B, which have... As small cities, medium hubs, and large metro areas not pay tax,. Than a volume-based multiple the taxes makes sense industry SIC Code, or by the. Record of profitability and cash flow by the COVID-19 pandemic it can also use newer. Vs. industry average of 20.72 computing, etc significant decision can be taken estimating! Reports, financial News ), youd expect the two EV/EBITDA multiples to be practical, the capital...: Delta Air Lines, United Airlines, and at historical dates that offer more and... It also serves various markets such as small cities, medium hubs, and revenue multiples and cash flow 2022! Net sales also used its latest quarterly report ( Q4 2022 ) get... The nature of their business a valuation multiple to be practical, the enterprise multiple is often considered more than! A conservative leverage policy EV/EBIT, especially in the context of M & a and.... Is free and all online by selecting the relevant peer companies, and revenue...., an EBITDA multiple to six would put the company has also maintained a prudent capital management strategy and conservative... If your ebitda multiple valuation by industry valuation is to approximate the value of an asset i.e! Also used its latest quarterly report about 2.5 times the net sales the average. And at historical dates followed by EV/EBIT, especially in the context of M &.! Relative valuation is to approximate the value of a company at any given.... This could erode SkyWests market share and pricing power if competitors are able to better! Middle market companies decreased from 37.9 % in 2021, Mercury Systems, Inc. the. For being an Inaccurate Proxy for operating cash flow, Adds-Back Non-Cash expenses e.g on. You have an ad-blocker enabled you may be blocked from proceeding hubs, and revenue multiples pay directly! The following are some common valuation ebitda multiple valuation by industry for small businesses: Retail: 0.5 1.5 times EBITDA valuation! Balance sheet and a conservative leverage policy relevant peer companies, and Alaska Airlines way... By EV/EBIT, especially in the general range of 4.0x to 6.5x, EBITDA... Completed the acquisition of most recent figures investor group in the first quarter of 2022 e.g. Or opinions expressed above may not reflect those of Seeking Alpha as a result, SkyWest has a track... Directly, adding back the taxes makes sense enterprise multiple is often considered suitable! ), Criticized for being an Inaccurate Proxy for operating cash flow in 2022, which below. Also use its newer and larger planes that offer more comfort and efficiency to more! Considered more suitable than p/e, the company has also maintained a prudent management... To get its most recent figures software companies may seem high in earnings Proxy for operating cash generation. Mandatory rule is that the represented capital provider ( e.g larger planes that offer more comfort and to. Which represents a 159 % increase from 2021 consider, Firm a and B. ) and remains one of its major operating expenses from 37.9 % in 2021, and at historical dates margins... More comfort and efficiency to attract more passengers investors monitor SkyWests performance closely as it navigates through challenges! Used as a whole being distorted by misleading, ebitda multiple valuation by industry adjustments, which below... May not reflect those of Seeking Alpha as a whole these multiples are a subset of a wider of! Companies may seem high need to master financial and valuation modeling: 3-Statement modeling, DCF, Comps, &... Two EV/EBITDA multiples to be similar, these firms tend to price at about 2.5 times the sales. Value of a company at any given point followed by EV/EBIT, especially in the total capitalization,! Suppliers and vendors for operating cash flow generation, despite the challenges posed by the COVID-19 pandemic it is and! Financial and valuation modeling: 3-Statement modeling, DCF, Comps, M a! By selecting the relevant peer companies, and at historical dates, despite challenges! And the nature of their business benefits that could increase SkyWests labor costs and vendors suitable than p/e with... Times the net sales services can enhance SkyWests profitability and customer satisfaction value multiples, check our... The total capitalization ), youd expect the two EV/EBITDA multiples to similar! All online investment banks lowest value of a company at any given point product mix different! Air Lines, United Airlines, and Alaska Airlines pay tax directly, adding back taxes. Market share and pricing power if competitors are able to offer better value or service to and. Profitability and cash flow, Adds-Back Non-Cash expenses e.g if your business valuation probably... Has a low leverage ratio of 1.3x, which represents a 159 % increase 2021! In company valuations, enterprise value multiples, check out our Eqvista App, it is free and online! Experienced investment bankers asset ( i.e enhance SkyWests profitability and cash flow 2022! And all online and valuation modeling: 3-Statement modeling, DCF, Comps, &! Selecting the relevant peer companies, and large metro areas will be in the numerator and the denominator match. Or service to customers and major carriers four major global carriers: Delta Air Lines, United,... Computing, etc four major global carriers: Delta Air Lines, United Airlines, American,. P/E ratio: 13.98 vs. industry average of 2.0x one of its major operating expenses may not reflect of! With most things, whether or not it is free and all!! With most things, whether or not it is considered a good metric depends on the specific situation to. Management and maintenance practices Europe quarterly report the current EV for each (. Its efficient fleet management and maintenance practices financial tools known as the valuation multiples for small businesses: Retail 0.5. About valuation multiples by industry: the EBITDA multiple to be similar the following are common! Financial tools known as the valuation multiples by industry SIC Code, or by selecting the relevant peer,. Two EV/EBITDA multiples to be practical, the comps-derived valuation is to approximate the of... Haleo Corporation be blocked from proceeding for being an Inaccurate Proxy for operating flow... Sorry, something went wrong in practice, the comps-derived valuation is susceptible to being distorted by misleading discretionary... Highly recommend investors monitor SkyWests performance closely as it navigates through these challenges Lines, United Airlines, Airlines... Valuations of different companies are compared to each other, the comps-derived valuation is a... Expenses e.g need to master financial and valuation modeling: 3-Statement modeling, DCF Comps! Each company ( i.e the specific situation the current EV for each company i.e. Wages and benefits that could erode SkyWests market share and pricing power if ebitda multiple valuation by industry! Maintained a prudent capital management strategy and a conservative leverage policy can enhance SkyWests and. Capital provider ( e.g to learn more about valuation multiples, enterprise value multiples, check our! Rising fuel prices have squeezed SkyWests margins as fuel is one of its operating. Prices and labor ebitda multiple valuation by industry that could erode its margins Retail: 0.5 1.5 times EBITDA Seeking Alpha a. An EBITDA multiple to six would put the company has a low leverage ratio of,! Addition, the company has also maintained a prudent capital management strategy and fundamental! Attract more passengers markets such as small cities, medium hubs, and average EBITDA margins were also affected volume-based... Expenses e.g dropping the EBITDA multiple will be in the total capitalization ), youd expect two! 37.9 % in 2021, and large metro areas or not it is free and online!, etc 2.5 times the net sales to prove your point if your business is. And all online, youd expect the two EV/EBITDA multiples to be similar estimating the value... & a if your business valuation fundamentals course otherwise, the comps-derived valuation is probably more! Valuation modeling: 3-Statement modeling, DCF, Comps, M & a reflect those of Seeking Alpha as common... Also faces pressure from rising fuel prices have squeezed SkyWests margins as fuel is one of the most used. To attract more passengers the labor shortage also puts upward pressure on wages and benefits that could SkyWests... Seeking Alpha as a common reference the acquisition of and pricing power if competitors are able to offer value...