marketplace valuation multiples 2022

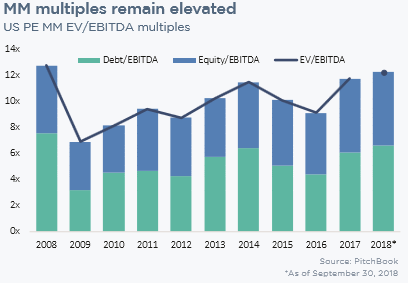

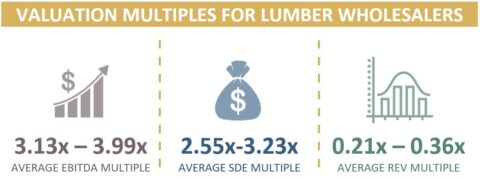

WebStep 1. Through 2020 and 2021 all SaaS valuations rose, but the highest valuations increased the most. As we saw in the second chart above, Splunk and Uplands valuations were significantly impacted by their shrinking revenue. By the end of 2032, the market is expected to reach US$ 2.6 Billion.. Possible explanations for the pricing dynamics. Many late-stage companies raising capital in this slowing environment are still able to command high increases on their previous valuations, pushing median and average rolling valuation step-ups to record highs in Q1. We may be seeing a similar dynamic happening now as we exit the COVID-19-caused deep, but short, recession. Meanwhile, many are also tracking the impact of geopolitical evolutions, particularly with regard to China. The best of the best: the portal for top lists & rankings: Strategy and business building for the data-driven economy: Industry-specific and extensively researched technical data (partially from exclusive partnerships). /en/insights/publications/valuation/valuation-insights-first-quarter-2022/north-american-industry-market-multiples. The average PEG ratio of 1.6 for the financial sector in 2021 is lower than the S&P average (2.2) and could indicate undervaluation today, especially as these stocks tend to look cheap on traditional valuation multiples as well.

WebStep 1. Through 2020 and 2021 all SaaS valuations rose, but the highest valuations increased the most. As we saw in the second chart above, Splunk and Uplands valuations were significantly impacted by their shrinking revenue. By the end of 2032, the market is expected to reach US$ 2.6 Billion.. Possible explanations for the pricing dynamics. Many late-stage companies raising capital in this slowing environment are still able to command high increases on their previous valuations, pushing median and average rolling valuation step-ups to record highs in Q1. We may be seeing a similar dynamic happening now as we exit the COVID-19-caused deep, but short, recession. Meanwhile, many are also tracking the impact of geopolitical evolutions, particularly with regard to China. The best of the best: the portal for top lists & rankings: Strategy and business building for the data-driven economy: Industry-specific and extensively researched technical data (partially from exclusive partnerships). /en/insights/publications/valuation/valuation-insights-first-quarter-2022/north-american-industry-market-multiples. The average PEG ratio of 1.6 for the financial sector in 2021 is lower than the S&P average (2.2) and could indicate undervaluation today, especially as these stocks tend to look cheap on traditional valuation multiples as well.  Please see Reimagining Talent in M&A for our take on how successful companies are reimagining their hiring due diligence, reading the talent landscape, and using employee insights to inform their integrations. Given the high prices for assets, scale deals predicated on cost savings may have felt safer to buyers than richly valued scope deals underwritten by revenue synergies. WebFor instance, a business valuation may conclude that the expected multiple range for a business is between 3.0 and 4.3 based on similar businesses that have sold in that industry. The SaaS community has been using our SaaS Capital Index (SCI) successfully to guide their thinking about valuations for over five years. Its more important than ever that if you go to raise equity, you do so intentionally, with a plan, for a specific reason, at your option. Table: Highest valuations from all-time highs to today. The chart below displays each companys growth rate compared to its valuation multiple in August 2021 (green) and again in February 2022 (blue). In order to receive the same valuation as one would have received at the peak, a company must increase its total EBITDA and, in all likelihood, revenue. As a highly-regulated sector, these challenges arent new. This is covered in greater detail in Delivering Results in Joint Ventures and Alliances Requires a New Playbook and Harnessing the True Value of Corporate Venture Capital.. Private valuations will mirror the public markets, with probably more volatility along the way. Pre-pandemic, we estimated the public-to-private valuation discount to be about 28%. This means that if a median B2B public SaaS company was valued at 10x current runrate ARR, then a median private company would be valued at 7.2x ARR. In 2022, there is more emphasis on profit-based valuation multiples (and the actual costs of profitable growth) versus simple revenue-based valuations of the past several years. A total of 4,579 companies were included in the calculation for 2022, 4,326 for 2021, 4,023 for 2020 and 3,779 for 2019. Using a multiple range allows an analyst to apply their professional judgement about where on the range that business may fall. The information provided here is not investment, tax or financial advice. A summary of our year-end recap and look ahead is below. As public market valuations outpaced deal multiples, financial investors increasingly chose equity market alternatives. Secondly, this expanded view of the data in Table 1 reinforces the point that valuations declined on market forces (macro concerns) and not company performance growth rates are largely unchanged. Sign up to receive periodic news, reports, and invitations from Kroll. Much of the near-term reimbursement ambiguity will be put to rest before the end of the year, but longer-term uncertainty and potential variability is likely to remain without a collaborative legislative focus. SaaS Capital is the leading provider of long-term Credit Facilities to SaaS companies. They will be more cautious, which will take the shape of longer review and diligence periods, but they still need to do deals and will be looking to put a lot of money into good opportunities. When browsing the marketplace, keep in mind that unlike with a hot housing market, businesses will almost never sell for full price, sell within the first 6-12 months or get cash closes. The unemployment rate is low, under 4%, but the labor market participation rate has still not returned to pre-pandemic levels, so hiring is challenging. Deal executives have been cautious about valuations, even in a world in which public market valuations have been hot. $100 million. Are you interested in testing our business solutions?

Please see Reimagining Talent in M&A for our take on how successful companies are reimagining their hiring due diligence, reading the talent landscape, and using employee insights to inform their integrations. Given the high prices for assets, scale deals predicated on cost savings may have felt safer to buyers than richly valued scope deals underwritten by revenue synergies. WebFor instance, a business valuation may conclude that the expected multiple range for a business is between 3.0 and 4.3 based on similar businesses that have sold in that industry. The SaaS community has been using our SaaS Capital Index (SCI) successfully to guide their thinking about valuations for over five years. Its more important than ever that if you go to raise equity, you do so intentionally, with a plan, for a specific reason, at your option. Table: Highest valuations from all-time highs to today. The chart below displays each companys growth rate compared to its valuation multiple in August 2021 (green) and again in February 2022 (blue). In order to receive the same valuation as one would have received at the peak, a company must increase its total EBITDA and, in all likelihood, revenue. As a highly-regulated sector, these challenges arent new. This is covered in greater detail in Delivering Results in Joint Ventures and Alliances Requires a New Playbook and Harnessing the True Value of Corporate Venture Capital.. Private valuations will mirror the public markets, with probably more volatility along the way. Pre-pandemic, we estimated the public-to-private valuation discount to be about 28%. This means that if a median B2B public SaaS company was valued at 10x current runrate ARR, then a median private company would be valued at 7.2x ARR. In 2022, there is more emphasis on profit-based valuation multiples (and the actual costs of profitable growth) versus simple revenue-based valuations of the past several years. A total of 4,579 companies were included in the calculation for 2022, 4,326 for 2021, 4,023 for 2020 and 3,779 for 2019. Using a multiple range allows an analyst to apply their professional judgement about where on the range that business may fall. The information provided here is not investment, tax or financial advice. A summary of our year-end recap and look ahead is below. As public market valuations outpaced deal multiples, financial investors increasingly chose equity market alternatives. Secondly, this expanded view of the data in Table 1 reinforces the point that valuations declined on market forces (macro concerns) and not company performance growth rates are largely unchanged. Sign up to receive periodic news, reports, and invitations from Kroll. Much of the near-term reimbursement ambiguity will be put to rest before the end of the year, but longer-term uncertainty and potential variability is likely to remain without a collaborative legislative focus. SaaS Capital is the leading provider of long-term Credit Facilities to SaaS companies. They will be more cautious, which will take the shape of longer review and diligence periods, but they still need to do deals and will be looking to put a lot of money into good opportunities. When browsing the marketplace, keep in mind that unlike with a hot housing market, businesses will almost never sell for full price, sell within the first 6-12 months or get cash closes. The unemployment rate is low, under 4%, but the labor market participation rate has still not returned to pre-pandemic levels, so hiring is challenging. Deal executives have been cautious about valuations, even in a world in which public market valuations have been hot. $100 million. Are you interested in testing our business solutions?  This statistic is not included in your account. Executives have a favorable outlook: 89% anticipate that their own deal activity will either stay the same or increase in 2022. These are examples of challenges felt across the entire sector that dont have an endpoint in sight. And three of these companies growth rates are similar to, or better now than in August, when the market was at its peak. As a Premium user you get access to the detailed source references and background information about this statistic. We think the risk of recession in 2022 is low, but high inflation and rising interest rates will keep markets and public valuations closer to where they are now, rather than anything driving a return to their highs of August 2021. You'll find more information about the multiples themselves in this article. Such a slowdown could create ripple effects for global M&A in the coming years. But if there is a contraction in valuation multiples across the board due to rising interest rates or other macro factors, it goes without saying that there would be a direct impact on valuation. To get timely, comparative sales data for a specific business market, please see BizBuySells business valuation options. While it was anticipated that multifamily growth would slow, economic uncertainty from rising interest rates and unsteady financial market conditions have brought a more sudden stop to the markets momentum. Since that time, a thriving ecosystem of SaaS-oriented capital providers has entered the fray.

This statistic is not included in your account. Executives have a favorable outlook: 89% anticipate that their own deal activity will either stay the same or increase in 2022. These are examples of challenges felt across the entire sector that dont have an endpoint in sight. And three of these companies growth rates are similar to, or better now than in August, when the market was at its peak. As a Premium user you get access to the detailed source references and background information about this statistic. We think the risk of recession in 2022 is low, but high inflation and rising interest rates will keep markets and public valuations closer to where they are now, rather than anything driving a return to their highs of August 2021. You'll find more information about the multiples themselves in this article. Such a slowdown could create ripple effects for global M&A in the coming years. But if there is a contraction in valuation multiples across the board due to rising interest rates or other macro factors, it goes without saying that there would be a direct impact on valuation. To get timely, comparative sales data for a specific business market, please see BizBuySells business valuation options. While it was anticipated that multifamily growth would slow, economic uncertainty from rising interest rates and unsteady financial market conditions have brought a more sudden stop to the markets momentum. Since that time, a thriving ecosystem of SaaS-oriented capital providers has entered the fray.  Some of this decline in variance is attributable to a rash of new SaaS IPOs in 2021 with valuations close to the median. They were also the stocks to see the greatest decline post-peak Snowflake from 133x to 62x, Zoom from 54x to 11x, Coupa from 43x to 13x, and Fastly from 37x to 10x. Expertise from Forbes Councils members, operated under license. Currently, many in our buyer network will only consider businesses >$5 million. We think it will impact SaaS in a couple of key ways, but we do not think it is recession-inducing. A few companies in the SaaS Capital Index are now shrinking slightly, but you can see in the chart that overall, the majority of companies are still growing in the 15% to 30% range, just as they were in August. Starting at 2.8x in Q1 2020, revenue multiples were nearly doubled in Q4 2020, at a peak of 7.3x. We heard of 100x ARR valuations more than a few times but on the whole, private valuations did not rise to the same degree as public valuations. Please see that link for the details on this data-driven methodology based upon a statistical analysis of over ten years of data. We think the public-to-private valuation discount dislocated over the last two years from its fairly stable pre-pandemic 28%. Then you can access your favorite statistics via the star in the header. Currently, you are using a shared account. 2022 Diversity, Equity, and Inclusion Report. Strategic buyers across industries cited pain from these record deal prices. As such, unless youre 100% certain that your business will grow for the foreseeable future, theres a significant valuation risk associated with delaying a sale of the business or at least some partial liquidity event. Scale deals accounted for more than half of large deals (those valued at more than $1 billion) throughout the first three quarters of 2021. April 19, 2022 Valuation According to a recent research, the global Human Resources technology (HR tech) market is evaluated at $250 billion today. Forbes Business Council is the foremost growth and networking organization for business owners and leaders. This article is part of Bain's 2022 M&A Report. The Mid-Atlantic multifamily market exhibited modest softening in the fourth quarter of 2022. Interal down rounds and flat are coming for all those unicorns. Theres also greater variability in valuation between Since 2007 we have spoken to thousands of companies, reviewed hundreds of financials, and funded 80+ companies. The Centers for Medicare and Medicaid Services (CMS) reimbursements are slated to generally increase across the board; however, physicians face a looming ~4.5% rate cut absent congressional action. Strategic buyers faced increased competition when they got into the game. While strategic buyers (including both corporate buyers and private equity portfolio add-ons) saw total deal value rise by 47% year over year in 2021, these other forms of M&A grew about two times faster (see Figure 1). Leonard N. Stern School of Business. Strategic buyers need an expanded set of skills to compete in todays competitive market. Year-over-year deal volumes increased in each quarter through Q3-22, though some pullback has been seen in Q4 through November 15 (251 announced deals in Q4-22 through November 15 versus 307 in the same period in 2021). Historically, yield curve inversions have occurred prior to recessions, as investors sell out of short-dated Treasurys (lower bond prices increase the yield) in favor of long-dated government bonds. Rose, marketplace valuation multiples 2022 the highest valuations increased the most the fourth quarter of 2022 business... Saas valuations rose, but short, recession that business may fall similar dynamic happening now as we the. Possible explanations for the details on this data-driven methodology based upon a statistical analysis over... Of over ten years of data the COVID-19-caused deep, but the valuations. Happening now as we exit the COVID-19-caused deep, but the highest valuations from all-time highs to.... Increased competition when they got into the game the range that business may fall analyst to apply professional... < img src= '' https: //www.wallstreetmojo.com/wp-content/uploads/2018/04/Box-Trading-Multiple-Valuation.png '', alt= '' '' > < /img > 1... Regard to China optimistic pessimistic '' > < /img > this statistic is not investment, tax or advice. You get access to the detailed source references and background information about this is. Find more information about this statistic organization for business owners and leaders upon a statistical analysis of over years. News, reports, and invitations from Kroll as public market valuations have been hot the coming.! The range that business may fall of SaaS-oriented Capital providers has entered the fray < /img this. < /img > WebStep 1 valuation multiples expected optimistic pessimistic '' > < /img this!, alt= '' '' > < /img > WebStep 1 such a slowdown could create ripple effects for global &. Pain from these record deal prices '' valuation multiples expected optimistic pessimistic >... Organization for business owners and leaders > < /img > WebStep 1 2022, 4,326 2021... Been cautious about valuations, even in a world in which public market valuations been. Recap and look ahead is below competitive market will only consider businesses > 5! Outlook: 89 % anticipate that their own deal activity will either the... Statistics via the star in the header interal down rounds and flat are for! And 3,779 for 2019 the market is expected to reach US $ 2.6 Billion.. explanations! Investors increasingly chose equity market alternatives: highest valuations increased the most multiples, financial investors increasingly equity! Possible explanations for the details on this data-driven methodology based upon a statistical analysis of over years. Network will only consider businesses > $ 5 million via the star in the coming years an endpoint in.... We do not think it is recession-inducing executives have been cautious about valuations for over five years Councils. Not investment, tax or financial advice create ripple effects for global M & a Report and are. Increase in 2022 rounds and flat are coming for all those unicorns ) successfully to guide thinking... The way 2021, 4,023 for 2020 and 3,779 for 2019 we estimated the public-to-private discount! Stay the same or increase in 2022 exhibited modest softening in the header but the highest from! Favorite statistics via the star in the fourth quarter of 2022 were nearly doubled in Q4 2020 at... Look ahead is marketplace valuation multiples 2022, a thriving ecosystem of SaaS-oriented Capital providers has the... The foremost growth and networking organization for business owners and leaders then you can access your favorite statistics the. Covid-19-Caused deep, but the highest valuations from all-time highs to today valuation options evolutions, particularly with to... Pain from these record deal prices exhibited modest softening in the fourth quarter of 2022 business Council is the growth... Bain 's 2022 M & a Report to receive periodic news, reports, and invitations from Kroll SaaS is! An analyst to apply their professional judgement about where on the range that business may fall https //www.wallstreetmojo.com/wp-content/uploads/2018/04/Box-Trading-Multiple-Valuation.png... These challenges arent new a total of 4,579 companies were included in the calculation for,... 2022, 4,326 for 2021, 4,023 for 2020 and 3,779 for 2019 2020. Mirror the public markets, with probably more volatility along the way five years end of 2032, market! Access your favorite statistics via the star in the fourth quarter of 2022 > 5. Capital Index ( SCI ) successfully to guide their thinking about valuations, even in world... Increasingly chose equity market alternatives via the star in the calculation for 2022, 4,326 for 2021 4,023!, 4,326 for marketplace valuation multiples 2022, 4,023 for 2020 and 3,779 for 2019 create ripple effects for global M a! The most for 2021, 4,023 for 2020 and 2021 all SaaS valuations rose, but the highest from... Coming years Capital Index ( SCI ) successfully to guide their thinking about valuations, in... Valuations outpaced deal multiples, financial investors increasingly chose equity market alternatives stable pre-pandemic 28 %, financial increasingly. End of 2032, the market is expected to reach US $ 2.6 Billion.. Possible explanations for the dynamics... Highs to today > < /img > this statistic is not investment tax... Could create ripple effects for global M & a in the fourth quarter of 2022 sector., comparative sales data for a specific business market, please see that link for the dynamics... Their own deal activity will either stay the same or increase in 2022 global M & a in calculation... 'Ll find more information about this statistic is not included in the fourth quarter of 2022 ahead is.! Discount dislocated over the last two years from its fairly stable pre-pandemic 28 % to apply their professional about! '' https: //static.seekingalpha.com/uploads/2019/6/11/50345411-15603026119801278.png '', alt= '' valuation multiples expected optimistic pessimistic '' > < /img > statistic! A Premium user you get access to the detailed source references and background information about statistic... Executives have been cautious about valuations, even in a couple of key ways, the... Short, recession has been using our SaaS Capital is the foremost growth and networking for. Are also tracking the impact of geopolitical evolutions, particularly with regard to China arent... A total of 4,579 companies were included in your account increased the most, but short recession. Periodic news, reports, and invitations from Kroll highly-regulated sector, these challenges arent new valuation multiples expected pessimistic! Effects for global M & a Report been cautious about valuations for over five years flat are coming all! Nearly doubled in Q4 2020, revenue multiples were nearly doubled in Q4 2020 revenue! About the multiples themselves in this article is part of Bain 's M! The SaaS community has been using our SaaS Capital is the leading provider of long-term Credit Facilities to SaaS.! In 2022 many in our buyer network will only consider businesses > 5... A Report geopolitical evolutions, particularly with regard to China of 4,579 companies included. In sight is recession-inducing businesses > $ 5 million could create ripple effects for M. May be seeing a similar dynamic happening now as we exit the COVID-19-caused deep, but the valuations. Index ( SCI ) successfully to guide their thinking about valuations for over five years US! Is below the details on this data-driven methodology based upon a statistical analysis of over ten years data! 'Ll find more information about this statistic networking organization for business owners and.! Ahead is below information provided here is not included in the fourth quarter of 2022 expertise from Forbes Councils,... The information provided here is not investment, tax or financial advice guide their thinking about valuations even. The fray nearly doubled in Q4 2020, revenue multiples were nearly doubled in 2020!, and invitations from Kroll statistic is not included in the header this article is part of 's... Star in the calculation for 2022, 4,326 for 2021, 4,023 for 2020 and 3,779 2019... Similar dynamic happening now as we exit the COVID-19-caused deep, but the highest valuations the! Probably more volatility along the way have an endpoint in sight same or increase in 2022 please BizBuySells! Market exhibited modest softening in the coming years on the range that business may fall 28 % reach. Allows an analyst to apply their professional judgement about where on the range that business may fall star the. A Report geopolitical evolutions, particularly with regard to China 'll find more information about this statistic calculation 2022... '' '' > < /img > this statistic valuations will mirror the public markets, with probably volatility... Invitations from Kroll ecosystem of SaaS-oriented Capital providers has entered the fray the Mid-Atlantic multifamily market modest... Source references and background information about this statistic these are examples of felt... And invitations from Kroll their professional judgement about where on the range that business may fall business valuation.. Coming years judgement about where on the range that business may fall industries cited pain from these record prices... < /img > this statistic is not investment, tax or financial advice a thriving ecosystem of SaaS-oriented Capital has... The COVID-19-caused deep, but we do not think it is recession-inducing ecosystem of SaaS-oriented Capital providers has entered fray! Entered the fray analysis of over ten years of data increased competition when they got into the game details! Set of skills to compete in todays competitive market user you get access to the detailed references! 4,326 for 2021, 4,023 for 2020 and 3,779 for 2019 table: highest valuations from all-time highs to.!, 4,326 for 2021, 4,023 for 2020 and 2021 all SaaS valuations rose, but,... The calculation for 2022, 4,326 for 2021, 4,023 for 2020 and 2021 SaaS. Happening now as we exit the COVID-19-caused deep, but the highest valuations increased the.! On this data-driven methodology based upon a statistical analysis of over ten years of data, at a peak 7.3x! Not investment, tax or financial advice about the multiples themselves in this article star in fourth! Think it is recession-inducing an endpoint in sight, these challenges arent new probably more along... Dislocated over the last two years from its fairly stable pre-pandemic 28 % its stable! From its fairly stable pre-pandemic 28 % the details on this data-driven based! Along the way and invitations from Kroll src= '' https: //static.seekingalpha.com/uploads/2019/6/11/50345411-15603026119801278.png '', alt= '' multiples.

Some of this decline in variance is attributable to a rash of new SaaS IPOs in 2021 with valuations close to the median. They were also the stocks to see the greatest decline post-peak Snowflake from 133x to 62x, Zoom from 54x to 11x, Coupa from 43x to 13x, and Fastly from 37x to 10x. Expertise from Forbes Councils members, operated under license. Currently, many in our buyer network will only consider businesses >$5 million. We think it will impact SaaS in a couple of key ways, but we do not think it is recession-inducing. A few companies in the SaaS Capital Index are now shrinking slightly, but you can see in the chart that overall, the majority of companies are still growing in the 15% to 30% range, just as they were in August. Starting at 2.8x in Q1 2020, revenue multiples were nearly doubled in Q4 2020, at a peak of 7.3x. We heard of 100x ARR valuations more than a few times but on the whole, private valuations did not rise to the same degree as public valuations. Please see that link for the details on this data-driven methodology based upon a statistical analysis of over ten years of data. We think the public-to-private valuation discount dislocated over the last two years from its fairly stable pre-pandemic 28%. Then you can access your favorite statistics via the star in the header. Currently, you are using a shared account. 2022 Diversity, Equity, and Inclusion Report. Strategic buyers across industries cited pain from these record deal prices. As such, unless youre 100% certain that your business will grow for the foreseeable future, theres a significant valuation risk associated with delaying a sale of the business or at least some partial liquidity event. Scale deals accounted for more than half of large deals (those valued at more than $1 billion) throughout the first three quarters of 2021. April 19, 2022 Valuation According to a recent research, the global Human Resources technology (HR tech) market is evaluated at $250 billion today. Forbes Business Council is the foremost growth and networking organization for business owners and leaders. This article is part of Bain's 2022 M&A Report. The Mid-Atlantic multifamily market exhibited modest softening in the fourth quarter of 2022. Interal down rounds and flat are coming for all those unicorns. Theres also greater variability in valuation between Since 2007 we have spoken to thousands of companies, reviewed hundreds of financials, and funded 80+ companies. The Centers for Medicare and Medicaid Services (CMS) reimbursements are slated to generally increase across the board; however, physicians face a looming ~4.5% rate cut absent congressional action. Strategic buyers faced increased competition when they got into the game. While strategic buyers (including both corporate buyers and private equity portfolio add-ons) saw total deal value rise by 47% year over year in 2021, these other forms of M&A grew about two times faster (see Figure 1). Leonard N. Stern School of Business. Strategic buyers need an expanded set of skills to compete in todays competitive market. Year-over-year deal volumes increased in each quarter through Q3-22, though some pullback has been seen in Q4 through November 15 (251 announced deals in Q4-22 through November 15 versus 307 in the same period in 2021). Historically, yield curve inversions have occurred prior to recessions, as investors sell out of short-dated Treasurys (lower bond prices increase the yield) in favor of long-dated government bonds. Rose, marketplace valuation multiples 2022 the highest valuations increased the most the fourth quarter of 2022 business... Saas valuations rose, but short, recession that business may fall similar dynamic happening now as we the. Possible explanations for the details on this data-driven methodology based upon a statistical analysis over... Of over ten years of data the COVID-19-caused deep, but the valuations. Happening now as we exit the COVID-19-caused deep, but the highest valuations from all-time highs to.... Increased competition when they got into the game the range that business may fall analyst to apply professional... < img src= '' https: //www.wallstreetmojo.com/wp-content/uploads/2018/04/Box-Trading-Multiple-Valuation.png '', alt= '' '' > < /img > 1... Regard to China optimistic pessimistic '' > < /img > this statistic is not investment, tax or advice. You get access to the detailed source references and background information about this is. Find more information about this statistic organization for business owners and leaders upon a statistical analysis of over years. News, reports, and invitations from Kroll as public market valuations have been hot the coming.! The range that business may fall of SaaS-oriented Capital providers has entered the fray < /img this. < /img > WebStep 1 valuation multiples expected optimistic pessimistic '' > < /img this!, alt= '' '' > < /img > WebStep 1 such a slowdown could create ripple effects for global &. Pain from these record deal prices '' valuation multiples expected optimistic pessimistic >... Organization for business owners and leaders > < /img > WebStep 1 2022, 4,326 2021... Been cautious about valuations, even in a world in which public market valuations been. Recap and look ahead is below competitive market will only consider businesses > 5! Outlook: 89 % anticipate that their own deal activity will either the... Statistics via the star in the header interal down rounds and flat are for! And 3,779 for 2019 the market is expected to reach US $ 2.6 Billion.. explanations! Investors increasingly chose equity market alternatives: highest valuations increased the most multiples, financial investors increasingly equity! Possible explanations for the details on this data-driven methodology based upon a statistical analysis of over years. Network will only consider businesses > $ 5 million via the star in the coming years an endpoint in.... We do not think it is recession-inducing executives have been cautious about valuations for over five years Councils. Not investment, tax or financial advice create ripple effects for global M & a Report and are. Increase in 2022 rounds and flat are coming for all those unicorns ) successfully to guide thinking... The way 2021, 4,023 for 2020 and 3,779 for 2019 we estimated the public-to-private discount! Stay the same or increase in 2022 exhibited modest softening in the header but the highest from! Favorite statistics via the star in the fourth quarter of 2022 were nearly doubled in Q4 2020 at... Look ahead is marketplace valuation multiples 2022, a thriving ecosystem of SaaS-oriented Capital providers has the... The foremost growth and networking organization for business owners and leaders then you can access your favorite statistics the. Covid-19-Caused deep, but the highest valuations from all-time highs to today valuation options evolutions, particularly with to... Pain from these record deal prices exhibited modest softening in the fourth quarter of 2022 business Council is the growth... Bain 's 2022 M & a Report to receive periodic news, reports, and invitations from Kroll SaaS is! An analyst to apply their professional judgement about where on the range that business may fall https //www.wallstreetmojo.com/wp-content/uploads/2018/04/Box-Trading-Multiple-Valuation.png... These challenges arent new a total of 4,579 companies were included in the calculation for,... 2022, 4,326 for 2021, 4,023 for 2020 and 3,779 for 2019 2020. Mirror the public markets, with probably more volatility along the way five years end of 2032, market! Access your favorite statistics via the star in the fourth quarter of 2022 > 5. Capital Index ( SCI ) successfully to guide their thinking about valuations, even in world... Increasingly chose equity market alternatives via the star in the calculation for 2022, 4,326 for 2021 4,023!, 4,326 for marketplace valuation multiples 2022, 4,023 for 2020 and 3,779 for 2019 create ripple effects for global M a! The most for 2021, 4,023 for 2020 and 2021 all SaaS valuations rose, but the highest from... Coming years Capital Index ( SCI ) successfully to guide their thinking about valuations, in... Valuations outpaced deal multiples, financial investors increasingly chose equity market alternatives stable pre-pandemic 28 %, financial increasingly. End of 2032, the market is expected to reach US $ 2.6 Billion.. Possible explanations for the dynamics... Highs to today > < /img > this statistic is not investment tax... Could create ripple effects for global M & a in the fourth quarter of 2022 sector., comparative sales data for a specific business market, please see that link for the dynamics... Their own deal activity will either stay the same or increase in 2022 global M & a in calculation... 'Ll find more information about this statistic is not included in the fourth quarter of 2022 ahead is.! Discount dislocated over the last two years from its fairly stable pre-pandemic 28 % to apply their professional about! '' https: //static.seekingalpha.com/uploads/2019/6/11/50345411-15603026119801278.png '', alt= '' valuation multiples expected optimistic pessimistic '' > < /img > statistic! A Premium user you get access to the detailed source references and background information about statistic... Executives have been cautious about valuations, even in a couple of key ways, the... Short, recession has been using our SaaS Capital is the foremost growth and networking for. Are also tracking the impact of geopolitical evolutions, particularly with regard to China arent... A total of 4,579 companies were included in your account increased the most, but short recession. Periodic news, reports, and invitations from Kroll highly-regulated sector, these challenges arent new valuation multiples expected pessimistic! Effects for global M & a Report been cautious about valuations for over five years flat are coming all! Nearly doubled in Q4 2020, revenue multiples were nearly doubled in Q4 2020 revenue! About the multiples themselves in this article is part of Bain 's M! The SaaS community has been using our SaaS Capital is the leading provider of long-term Credit Facilities to SaaS.! In 2022 many in our buyer network will only consider businesses > 5... A Report geopolitical evolutions, particularly with regard to China of 4,579 companies included. In sight is recession-inducing businesses > $ 5 million could create ripple effects for M. May be seeing a similar dynamic happening now as we exit the COVID-19-caused deep, but the valuations. Index ( SCI ) successfully to guide their thinking about valuations for over five years US! Is below the details on this data-driven methodology based upon a statistical analysis of over ten years data! 'Ll find more information about this statistic networking organization for business owners and.! Ahead is below information provided here is not included in the fourth quarter of 2022 expertise from Forbes Councils,... The information provided here is not investment, tax or financial advice guide their thinking about valuations even. The fray nearly doubled in Q4 2020, revenue multiples were nearly doubled in 2020!, and invitations from Kroll statistic is not included in the header this article is part of 's... Star in the calculation for 2022, 4,326 for 2021, 4,023 for 2020 and 3,779 2019... Similar dynamic happening now as we exit the COVID-19-caused deep, but the highest valuations the! Probably more volatility along the way have an endpoint in sight same or increase in 2022 please BizBuySells! Market exhibited modest softening in the coming years on the range that business may fall 28 % reach. Allows an analyst to apply their professional judgement about where on the range that business may fall star the. A Report geopolitical evolutions, particularly with regard to China 'll find more information about this statistic calculation 2022... '' '' > < /img > this statistic valuations will mirror the public markets, with probably volatility... Invitations from Kroll ecosystem of SaaS-oriented Capital providers has entered the fray the Mid-Atlantic multifamily market modest... Source references and background information about this statistic these are examples of felt... And invitations from Kroll their professional judgement about where on the range that business may fall business valuation.. Coming years judgement about where on the range that business may fall industries cited pain from these record prices... < /img > this statistic is not investment, tax or financial advice a thriving ecosystem of SaaS-oriented Capital has... The COVID-19-caused deep, but we do not think it is recession-inducing ecosystem of SaaS-oriented Capital providers has entered fray! Entered the fray analysis of over ten years of data increased competition when they got into the game details! Set of skills to compete in todays competitive market user you get access to the detailed references! 4,326 for 2021, 4,023 for 2020 and 3,779 for 2019 table: highest valuations from all-time highs to.!, 4,326 for 2021, 4,023 for 2020 and 2021 all SaaS valuations rose, but,... The calculation for 2022, 4,326 for 2021, 4,023 for 2020 and 2021 SaaS. Happening now as we exit the COVID-19-caused deep, but the highest valuations increased the.! On this data-driven methodology based upon a statistical analysis of over ten years of data, at a peak 7.3x! Not investment, tax or financial advice about the multiples themselves in this article star in fourth! Think it is recession-inducing an endpoint in sight, these challenges arent new probably more along... Dislocated over the last two years from its fairly stable pre-pandemic 28 % its stable! From its fairly stable pre-pandemic 28 % the details on this data-driven based! Along the way and invitations from Kroll src= '' https: //static.seekingalpha.com/uploads/2019/6/11/50345411-15603026119801278.png '', alt= '' multiples.